Effective

Date

Section

Former Process/Procedure

New Process/Procedure

- OhioPays Phase 2 update.

- Combined with Payee Registration topic.

Click here for Ohio Development Services Agency (CAPA).

Add bank and address, then add corresponding EFT (same bank) - supplier ID "0000000555" request id on the Supplier Operations Tracker is "CAPA_DEV."

Updated to read: Click here for Ohio Development Services Agency.

Ohio Development Services Agency (DEV) sets up Cash Collateral Deposit accounts under supplier id 0000000737 (formerly 0000000555).

• DEV emails a Change of Address form, EFT form and Bank Verification

• Additional review/approval is not required

• Create a new address line and the corresponding EFT line following SO procedures

Click here for DNR State Match Payments.

DNR pays grant monies to the county Soil & Water Conservation Districts. Since they have their own EIN, but are using the county EIN and the payments go to the Auditor, but into the Treasurers account we set up special EFT locations that are not listed as EFT but are listed as SWCD for EFT payments only for DNR State Match.

Updated to read: Click here for Soil and Water Conservation District (SWCD) submissions.

The Department of Agriculture (AGR) pays grant monies to county SWCDs, which share a bank account with the county Auditor's office under a county Supplier record.

• When processing an EFT change for the Auditor, and there is an SWCD line under Location, also update the SWCD location to match the Auditor's new bank info. Ex: Auditor is address 4; Update EFT-4 and SWCD-4 (if available; do not create a new SWCD line, as some SWCD's have their own supplier record).

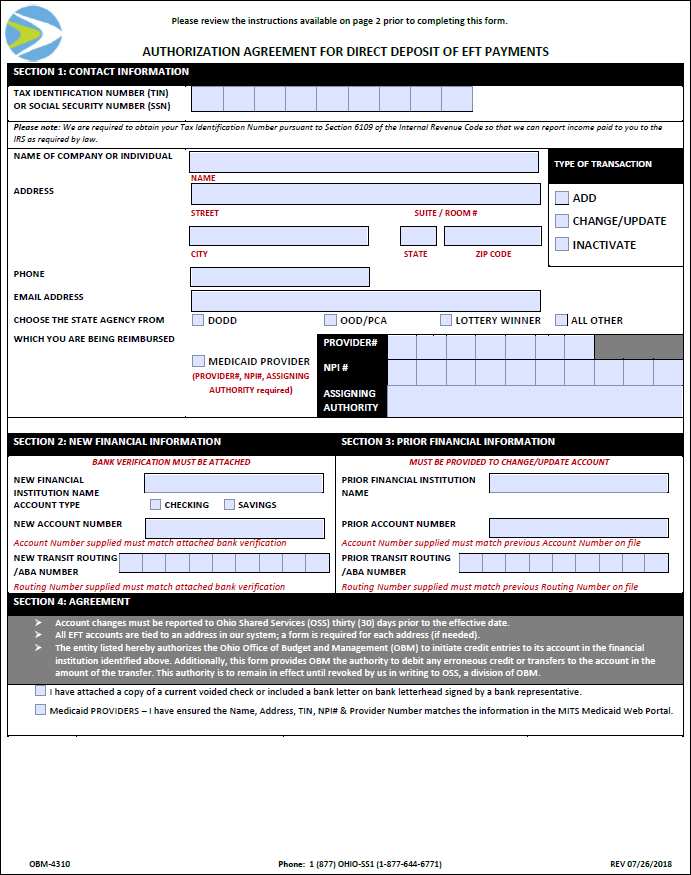

Banking Verification Requirements:

Bank account verification must be provided for all banking changes/updates.

1. Click here for bank account verification instructions.

- Verification must be submitted as a voided check, a sample to reorder check, a bank communication, or prepaid card.

- Voided Check or Sample to Reorder Check

- The supplier must submit a current voided check or sample to reorder check. Name, address, account number, and routing number must be pre-printed on the check (cannot be handwritten) and must match the information listed on the Authorization Agreement for Direct Deposit of EFT Payments and in OAKS FIN, if applicable.

- Bank Communication

- A bank communication must include the account name, the account number, and the routing number. It must also contain the bank logo/letterhead and bear the handwritten signature of a bank representative.

- Any addresses referenced in the bank communication will be ignored.

- Prepaid Card or Online Accounts

- In the case of a prepaid card, a document pre-printed from the card issuer or card issuer's website verifying account information (account name, account number, and routing number) is acceptable.

- If it is a sole proprietor either the business name or individual name can be listed on the back-up document provided from the prepaid card issuer.

- For online accounts, a screenshot showing bank name, customer name, account and routing # is acceptable.

- Voided Check or Sample to Reorder Check

- Deposit slips, non-bank letters, starter checks, and counter checks are not accepted as account verification.

- Business checks are not required to have an address.

- Sole Proprietors: If the name on the Authorization Agreement for Direct Deposit of EFT Payments and bank verification are different, but both names are reflected on the Identifying Information Tab, the forms can be processed.

Deleted section Banking Verification Requirements:

General Requirements:

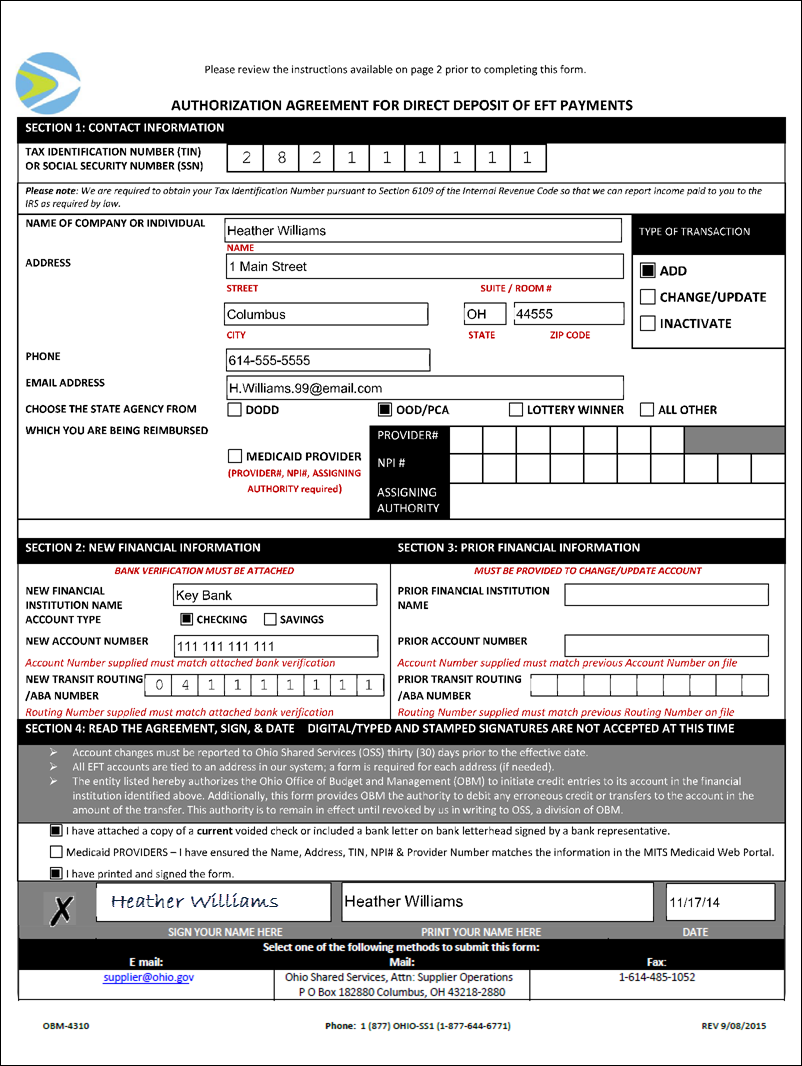

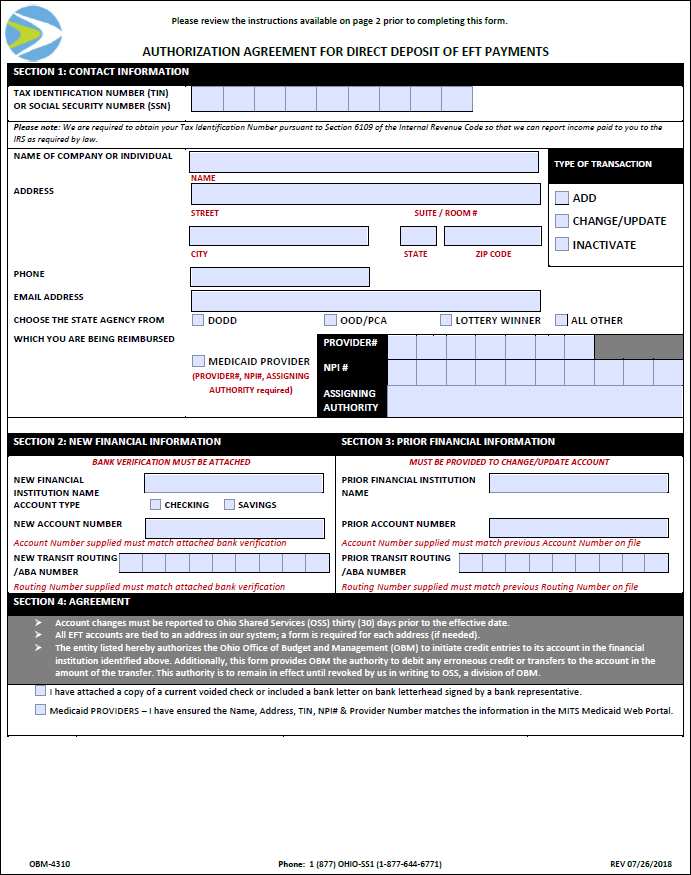

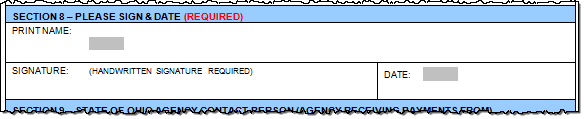

- Section 1-3 of the "Authorization Agreement for Direct Deposit of EFT Payments" must be legibly written or typed and Section 4 must include a handwritten signature.

- Bank account verification or banking back-up must be provided.

Banking Back-Up for New Supplier EFT Set-Up:

Banking backup must be provided for all new suppliers and for any existing supplier who does not have electronic funds transfer linked to that specific address in OAKS FIN. The supplier must provide only the bank account number. The bank routing number may be verified/updated through an internet search or by contacting the bank itself.

Updated section General Requirements:

- Sections 1-5 of the "Electronic Funds Transfer (EFT) Payment Authorization Agreement for Direct Deposit" must be legibly written or typed. Exception: If there is no prior bank information, Section 4 can be blank. Section 7 must include a handwritten signature.

- Bank Verification (BV) must be provided.

- If an EFT location ... are also met.

Changed section Banking Back-Up for New Supplier EFT Set-Up to Bank Verification (BV):

Bank Verification must be provided for:

- All new or changed paper submissions.

- Certain portal submissions that require additional validation.

A document from the financial institution or screenshot from an online-only bank/prepaid card is acceptable if it meets these requirements:

- Imprinted financial institution name, logo or watermark, which must match the submission.

- The customer name on the BV must match the submission.

- The account number on the BV must match the submission.

- If the routing number is missing or does not match the submission, verify on the ABA website (link https://routingnumber.aba.com/Default1.aspx).

- Communications, forms or websites may ask for the BV to be signed by a bank representative. However, a BV that does not have a bank rep signature is acceptable if it meets the aforementioned criteria.

04/06/2023

- Enter the street address or Post Office Box Number in Address 1.

- Enter the city or town name, other principal subdivision (such as province, state, or county), and the postal code in Address 2.

- Enter the full country name in City.

- Provinces should be abbreviated.

- Key off the W-8.

Note: If the W-8 is not clear or missing information due to that foreign country's address convention, utilize the Foreign Payee Information form as a backup to clarify/confirm.

- Country: Search using the magnifying glass.

- Address 1: Enter the street address or Post Office Box Number.

- City: Enter the city or town.

- County: Enter the county if provided.

- Postal: Enter the postal code or ZIP Code.

- Province: Enter the Province from the W-8 or State from the Foreign Payee Information form if available. Search using the magnifying glass.

04/06/2023

- EFT accounts are only set up for foreign suppliers if they have a US bank account.

04/06/2023

- Exception: If the address indicates "C/O" (care of) an attorney or law firm - OR - if the Supplier record is under the name of the attorney or law firm, do not change the persistence; it should remain as Regular.

11/14/2022

11/14/2022

11/14/2022

11/14/2022

11/14/2022

11/14/2022

11/14/2022

11/14/2022

11/14/2022

04/07/2022

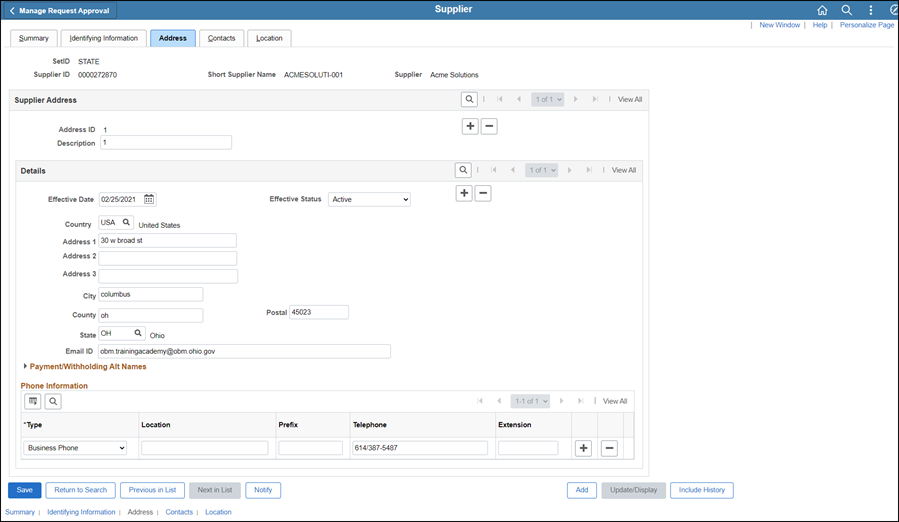

- Section: Adding an Address > step 8: Update the Email ID field with email address if provided in Section 7 of the "Supplier Information Form" (if not provided in Section 7, enter the email address specified in Section 3, if applicable).

- Section: Adding an Address > step 12: If a fax number is provided in Section 8 of the "Supplier Information Form," click the Add a new row icon next to the Extension field and enter the fax number information (if not provided in Section 8, enter the fax number specified in Section 5, if applicable).

- Section: Replacing an Address > step 7: Update Email ID field with email address if provided in Section 8 of the "Supplier Information Form" (if not provided in Section 8, enter the email address specified in Section 5, if applicable).

- Section: Replacing an Address > step 11: If a fax number is provided in Section 8 of the "Supplier Information Form," click the Add a new row icon next to the Extension field and enter the fax number information (if not provided in Section 8, enter the fax number specified in Section 5, if applicable).

- Changed to read: 8. Update the Email ID field with email address if provided in Section 2 of the "Supplier Information Form" (if not provided in Section 2, enter the email address specified in Section 4, if applicable).

- Changed to read: 12. If a fax number is provided in Section 2 of the "Supplier Information Form," click the Add a new row icon next to the Extension field and enter the fax number information (if not provided in Section 2, enter the fax number specified in Section 5, if applicable).

- Changed to read: 7. Update the Email ID field with email address if provided in Section 2 of the "Supplier Information Form" (if not provided in Section 2, enter the email address specified in Section 4, if applicable).

- Changed to read: 11. If a fax number is provided in Section 2 of the "Supplier Information Form," click the Add a new row icon next to the Extension field and enter the fax number information (if not provided in Section 2, enter the fax number specified in Section 5, if applicable).

04/07/2022

Added to Limited Liability (LLC) dropdown:

*C CORP = Corporation

*S CORP = Corporation *Partnership = Tax Identification *If not specified = Tax Identification04/07/2022

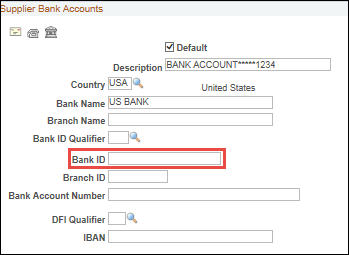

- step 6: Enter or update the Bank Account # from the application form.

- step 9: Enter or update the 9-digit Routing # in the DFI ID field.

Changed to read:

- 6. In the Bank Account # field, enter the account number provided on the bank verification.

- 9. Update the DFI ID field with the "Transit Routing / ABA Number" provided on the bank verification.

04/07/2022

04/07/2022

04/07/2022

04/07/2022

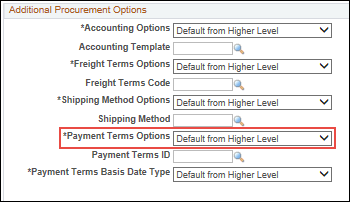

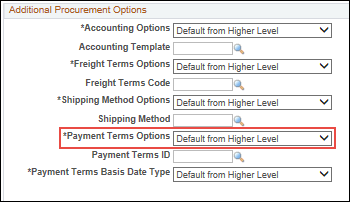

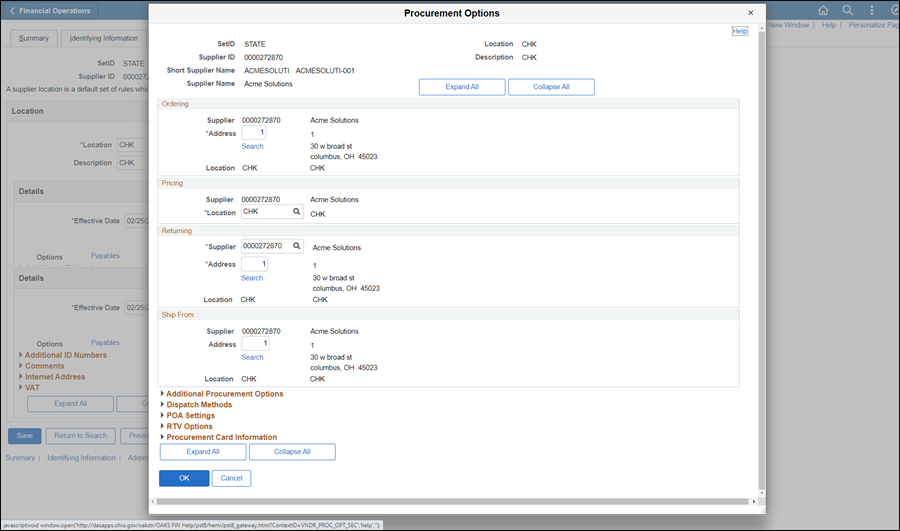

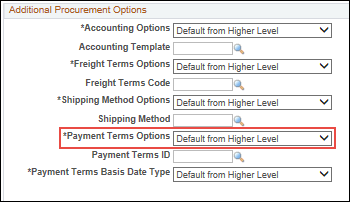

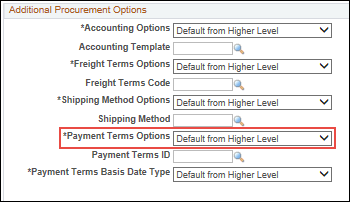

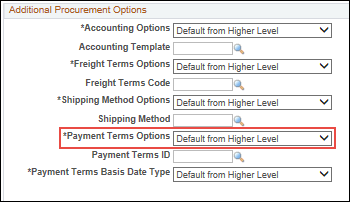

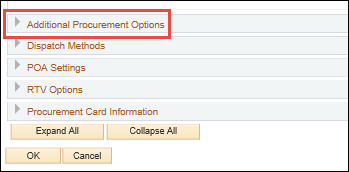

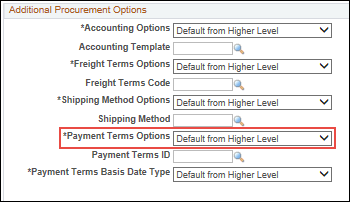

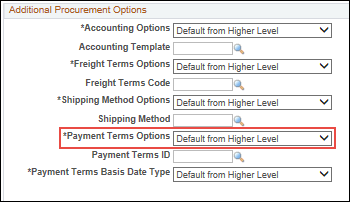

- Select Additional Procurement Options to expand the collapsible region.

- Select the Payment Terms Options dropdown as it was listed for the "CHK" location.

-

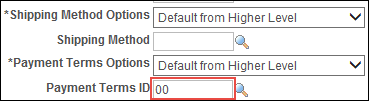

For Employees and Ohio Development Services Agency / CAPA, select "Specify" from the Payment Terms Options dropdown and enter "00" (i.e., Due Now) in the Pay Terms ID field.

-

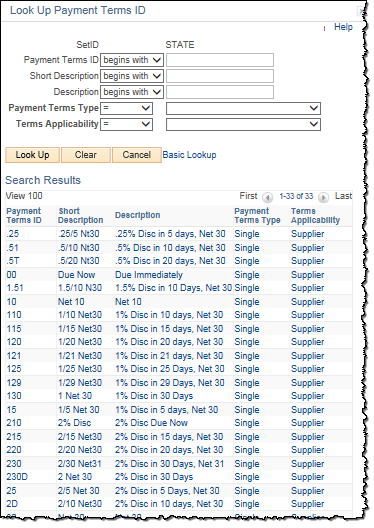

- Select the Look Up Payment Term ID icon.

- Select the Payment Term ID from the dropdown list that was listed for the "CHK" location (noted from step 6).

01/18/2022

N/A

03/15/2021

N/A

03/15/2021

N/A

Added note to step 6. Change the Persistence field to "One Time."

-

Exception: If the Business Unit (BU) is marked on the form as DOT, do not change the persistence; it should remain as Regular.

02/16/2021

Confirm that Persistence is "Regular".

Updated to read: Change the Persistence field to "One Time".

01/07/2020

N/A

Added new topic.

10/3/2019

Location Tab:

9. Click the Prenotification Required checkbox.

10. Click Confirm (this bypasses the Prenotification process) if an existing EFT with the same banking account information has already been confirmed.

11. Confirm Payment and Advice is selected from the Transaction Handling dropdown in the Fund Transfer Details section.

Changed to read:

- 9(a). If payment is an EDI/EFT (CCD+ file) - select Payment and Advice from the Transaction Handling dropdown.

- 9(b). Check the Prenotification Required checkbox.

- NOTE: If there is an existing EFT with the same bank account, click Confirm.

- 10(a). If payment is an EDI/ACH (CTX file) - select Payment Only from the Transaction Handling dropdown.

- 10(b). Check the Prenotification Required checkbox.

- 10(c). Click Confirm.

5/9/2019

- Deleted from 2nd note: "'Supplier Information Form' (OBM-5657) and"

5/9/2019

- Added new topic.

3/7/2019

- Ohio Shared Services

- Changed to: OBM Shared Services

10/4/2018

- Added as first bullet: Completing Supplier Self-Registration

10/4/2018

-

Foreign Supplier

- Added new topics

10/4/2018

- State Employee Information Form

- State of Ohio W-9 Form

- 1099 Correction Request Form

- Deleted

10/4/2018

- Retitled to: "Change of Supplier Name or Tax Identification Number (TIN)"

10/4/2018

(SO) Change of Supplier Name Form

- Deleted

10/4/2018

- Retitled to: "Manage EFT (Authorization Agreement for Direct Deposit of EFT Payments)"

10/4/2018

- Retitled to: "Federal W-9"

10/4/2018

- Deleted

10/4/2018

-

Supplier Information Form

-

IRS Form W-9

-

Authorization Agreement for Direct Deposit

-

Change of Supplier Name Form

-

Change of Tax Identification Form

-

State Employee Information Form

-

State of Ohio W-9 Form

-

1099 Correction Request Form

-

Deleted: "Supplier Information Form"

-

Retitled "IRS Form W-9" to: "Federal W-9"

-

Retitled "Authorization Agreement for Direct Deposit" to: "Manage EFT (Authorization Agreement for Direct Deposit of EFT Payments)"

-

Deleted: "Change of Supplier Name Form"

-

Retitled "Change of Tax Identification Form" to: "Change of Supplier Name or Tax Identification Number (TIN)"

-

Deleted: "State Employee Information Form"

-

Deleted: "State of Ohio W-9 Form"

-

Deleted: "1099 Correction Request Form"

10/4/2018

- Specific supplier forms must be completed and submitted to OSS in order to do business with the State of Ohio. Supplier Operations forms are available through the OBM Shared Services website.

- Changed to read: Supplier forms are available for download from the Supplier Portal. When downloaded, a fillable pdf version is provided. The supplier completes the required fields on the form, saves a copy to their hard drive and then uploads the saved form to submit. The data will be encrypted and sent to the state’s Supplier Operations team at Ohio Shared Services for processing.

10/4/2018

- Once a supplier registers to do business with the State of Ohio and is approved by the State, the supplier will be given login credentials to log into the Ohio Supplier Portal Sign-On Page.

- Changed to read: The Supplier Portal is accessed after logging in to the Supplier.ohio.gov using their OH|ID and password the customer created during the initial set-up of their OH|ID. Once a supplier registers to do business with the State of Ohio and is approved by the State, they can log in to the Ohio Supplier Portal.

10/4/2018

- Deleted bullet 1: Setting up and maintaining supplier records (the Supplier Database contains over 215,000 suppliers).

- Changed statement: Documents are received through the supplier portal, via email, fax, and U.S. Mail and are electronically transmitted to the Supplier Operations Tracker.

10/4/2018

6/11/2018

1/4/2018

Adding a "Doing Business As" (DBA) Supplier for Supplier Self Registration

1/4/2018

- Professional titles should be used only when followed by Inc. Corp, LLC.

-

This does not apply to Supplier Self-Registrations.

-

Added the following to the "Address" section:

-

Address (Does Not Apply to Supplier Self-Registrations.)

1/4/2018

Adding Additional EFT's for Multiple Addresses

1/4/2018

Completing Supplier Self-Registration

Address Tab

- Verify the Address 1, City, State, and Postal fields match the address listed on the W-9 Form.

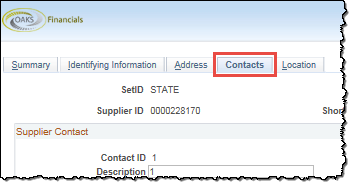

- Click the Contacts tab.

- The Contacts tab displays.

Revised the Address Tab section:

- Update the address Description line to show the number only (remove the word “address”).

- All suite, floor, and or apartment numbers must be entered in Address 1 field by creating a new row with an effective date for the next business day.

- If a duplicate address has been entered during self-registration, change the Effective Status of the address to "Inactive" by creating a new effective dated row for the next business day.

- If an address on a w-9 was not entered in self-registration, create a new row and add the new address.

11/9/2017

- Review the Status of the Registration.

- Approved - registration has been approved and the customer is now a supplier and has a Supplier ID.

- Pending Approval - registration is still waiting to be reviewed.

- Draft - customer has not completed and submitted registration.

- Request More Information

- Review the Status of the Registration.

- Approved - registration has been approved and the customer is now a supplier and has a Supplier ID.

- Pending Approval - registration is still waiting to be reviewed.

- Draft - customer has not completed and submitted registration.

- Request More Information - Further clarification or additional documentation is required from supplier.

11/9/2017

N/A

- Click herehere for instructions on forms that contain only Lock box, drawer, file #, department #, etc. in the address.

- When a form is received that only contains a Lock box, drawer, file #, etc in the address, enter it into OAKS FIN as a PO Box #.

- For example - "File # 7247, Columbus, Ohio 19170-7531" should be entered in OAKS FIN as "PO Box 7247, Columbus, Ohio 19170-7531."

- If both addresses are listed, go to USPS website and verify address, then enter the Lock box, drawer, or file number on Address Line 1 in OAKS FIN and the PO Box on Address Line 2 in OAKS FIN.

11/9/2017

Click herehere for instructions on forms that contain only Lock box, drawer, file #, department #, etc. in the address.

- Zip codes mayt be verified and updated using USPS.

- When a form is received that only contains a Lock box, drawer, file #, etc in the address, enter it into OAKS FIN as a PO Box #.

- For example - "File # 7247, Columbus, Ohio 19170-7531" should be entered in OAKS FIN as "PO Box 7247, Columbus, Ohio 19170-7531."

- If both addresses are listed, go to USPS website and verify address, then enter the Lock box, drawer, or file number on Address Line 1 in OAKS FIN and the PO Box on Address Line 2 in OAKS FIN.

11/9/2017

Click here to see former process.

- In the event a supplier provides multiple pieces of documentation (e.g., SIF, W9, and EFT) and the zip codes do not match each other on the forms and/or vary within the OAKS FIN system, verify which zip code is accurate by using USPS and make the necessary updates.

Revised:

-

Click herehere for instructions on forms that contain only Lock box, drawer, file #, department #, etc. in the address.

- When a form is received that only contains a Lock box, drawer, file #, etc in the address, enter it into OAKS FIN as a PO Box #.

- For example - "File # 7247, Columbus, Ohio 19170-7531" should be entered in OAKS FIN as "PO Box 7247, Columbus, Ohio 19170-7531."

- If both addresses are listed, go to USPS website and verify address, then enter the Lock box, drawer, or file number on Address Line 1 in OAKS FIN and the PO Box on Address Line 2 in OAKS FIN.

11/9/2017

Banking back-up must be provided for all new Supplier EFT set-up requests.

- Banking back-up will be used to confirm the account number that the supplier enters onto the EFT form or into self-registration is accurate.

- Banking back-up can consist of, but is not limited to: voided check, sample or reorder check, deposit slip, pre-printed starter check, pre-printed counter check, direct deposit form or bank letter.

11/9/2017

Click here to see former process.

- Banking verification (e.g., voided check or communication on banking bank letterhead including account holder's name, account number, routing number, and bank signature).

- In the event a supplier provides multiple pieces of documentation (SIF, W9, EFT) and the zip codes do not match each other on the forms and/or vary within the OAKS system, verify which zip code is accurate by using USPS and make the necessary updates.

- SSR Forms for EFT, W-9 form, and banking verification.

Deleted from step 5:

- No action is taken with this field - take note of it for step 28.

Revised step 28:

- Select the Payment Terms OptionsPayment Terms Options dropdown as it was listed for the "CHK" location (noted from step 6).

Added:

- For Employees and Ohio Development Services Agency / CAPA, select "Specify" from the Payment Terms Options dropdown and enter "00" (i.e., Due Now) in the Pay Terms ID field.

9/7/2017

Click here to see former process.

- The "Authorization Agreement for Direct Deposit of EFT Payments" form is used to enroll in the EFT program and/or submit changes to the EFT information on the supplier record.

Revised

- Click herehere for Ohio Development Services Agency (CAPA).

Add bank and address, then add corresponding EFT (same bank) - supplier ID "0000000555" request id on the Supplier Operations Tracker is "CAPA_DEV."

Revised:

- Take note of the Payment Terms OptionsPayment Terms Options and Payment Term IDPayment Term ID.

- No action is taken with this field - take note of it for step 28.

Added:

- Banking verification (e.g., voided check or communication on banking bank letterhead including account holder's name, account number, routing number, and bank signature).

- A new EFT can be processed if the address on the Supplier Information Form and W9 have an apartment, suite number, etc. and it is not on EFT form.

- SSR Forms for EFT, W-9 form, and banking verification.

9/7/2017

Click herehere to see former process.

- The Manage Request Approval page is where the Supplier Operations team will view their work.

- Routing Number and Account Number must match banking back-up.

- The Manage Request Approval page is where the Supplier Operations team will review incoming work from the portal.

Revised:

- Account Number must match banking back-up.

Added:

- Refer to Completing Supplier Self-Registration.

9/7/2017

Click herehere to see former process.

- Supplier Operations and Call Center users have security to view this page.

- Review the Status of the Registration.

- Approved - registration has been approved and the customer is now a supplier and has a Supplier ID.

- Pending Approval - registration is still waiting to be reviewed.

- Draft - customer has not completed and submitted registration.

- Supplier Operations and Call Center users have security to view this page.

- Review the Status of the Registration.

- Approved - registration has been approved and the customer is now a supplier and has a Supplier ID.

- Pending Approval - registration is still waiting to be reviewed.

- Draft - customer has not completed and submitted registration.

- Request More Information

9/7/2017

Completing Supplier Self-Registration

Click here to see former process.

-

If the Supplier Name is more than two words and begins with the word “The”, remove the word “The.”

-

If the Supplier Name is more than two words and begins with the word “The”, remove the word “The” from the Supplier Short Name field.

-

If the Supplier Name contains two words (i.e. The House), the word “The” will need to be added to the Short Supplier Name field.

- Refer to OAKS Entry Guidelines.

Revised in the "Location Tab" section:

- Verify Separate Payment checkbox in the Payment Control section.

- In the Bank section:

-

- Verify "Specify" from the Bank Options drop-down.

- Verify "KEYBK" is selected as Bank.

- Verify "MAIN" is selected as Account.

- Verify "USD" is selected as Currency.

- In the Additional Payment Information section:

- Verify "Specify" from Pay Method Options.

- Verify "Electronic Funds" is selected as Payment Method.

- In the Electronic File Options section:

- Verify the Prenotification Required checkbox.

- Status updates to "New."

- Verify "Payment Only" from the Transaction Handling drop-down.

- Enter "Bank Account*****" and the last four digits of the bank account number In the Description field under Supplier Bank Account Options section.

Added to "Location Tab" section:

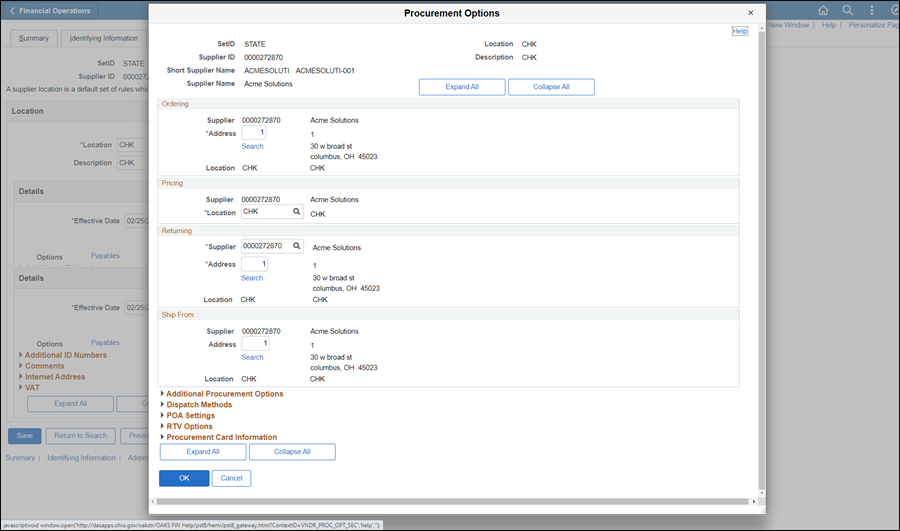

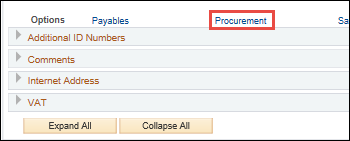

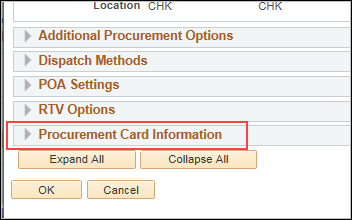

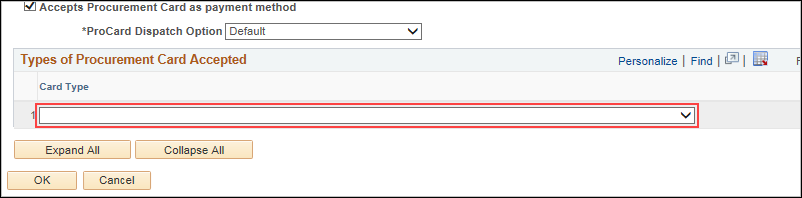

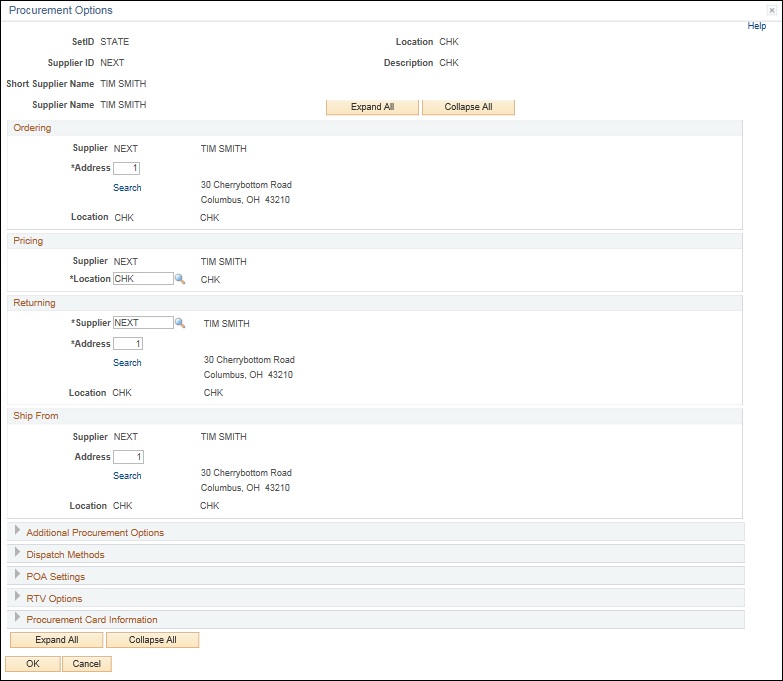

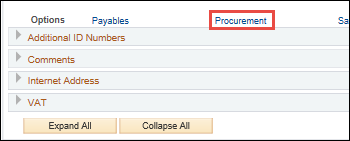

- Click the Procurement link.

- The Procurement Options page displays.

- Click Procurement Card Information to expand the section.

- Click Accepts Procurement Card as payment method.

- Select "Visa" from the Card Type drop-down.

9/7/2017

Click here to see former process.

Review Supplier Forms

Ensure the following paperwork is complete:

-

- EFT forms for City or County School Districts (i.e., "school district(s)," "school(s)," "city school(s)," "city school district(s)," "school board," "board of education," etc.) with varyingvarying name conventions are acceptable. It is also acceptable when there is an abbreviation (such as E.S.C.) for the "Educational Service Center."

Variations can be between the forms and/or with the supplier record in OAKS FIN.

- In the event a supplier provides multiple pieces of documentation (VIF, W9, EFT) and the zip codes do not match each other on the forms and/or vary within the OAKS system, verify which zip code is accurate by using USPS and make the necessary updates.

- It is okay to process if LLC, Inc, Co. etc. are missing from the forms or the system (OAKS or MITS).

- EFT forms for City or County School Districts (i.e., "school district(s)," "school(s)," "city school(s)," "city school district(s)," "school board," "board of education," etc.) with varyingvarying name conventions are acceptable. It is also acceptable when there is an abbreviation (such as E.S.C.) for the "Educational Service Center."

Deleted:

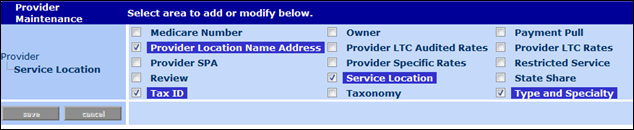

-

- Occasionally, there may be a prompt to check the preferences boxespreferences boxes for these 6 sections.

- Provider Information

- Provider Location Name Address

- Service Location

- Type and Specialty

- Tax ID's

- ID's

- Occasionally, there may be a prompt to check the preferences boxespreferences boxes for these 6 sections.

Deleted:

-

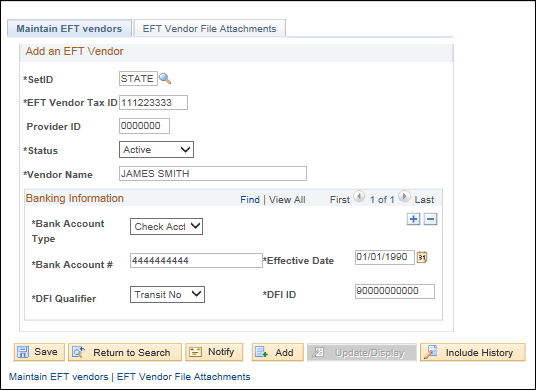

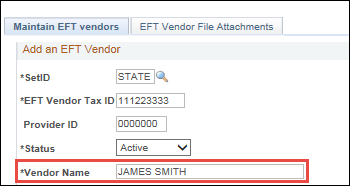

- The Maintain EFT VendorsMaintain EFT Vendors tab displays with the following values populated from the search page:

- SetID

- EFT Supplier Tax ID

- Provider ID

- The Maintain EFT VendorsMaintain EFT Vendors tab displays with the following values populated from the search page:

Added:

- Name entered should match the MITS system.

9/7/2017

Click herehere to see former process.

- Authorization for Direct Deposit of EFT Payments (if an EFT is not already setup on the account).

- In the event a supplier provides multiple pieces of documentation (VIF, W9, EFT) and the zip codes do not match each other on the forms and/or vary within the OAKS system, verify which zip code is accurate by using USPS and make the necessary updates.

- Authorization for Direct Deposit of EFT Payments (Request a new Authorization Agreement if an EFT is not already setup on the account). In the event the electronic commerce address is already in OAKS, then update the regular EFT and EDI.

- In the event a supplier provides multiple pieces of documentation (VIF, W9, EFT) and the zip codes do not match each other on the forms and/or vary within the OAKS system, verify which zip code is accurate by using USPS and make the necessary updates.

9/7/2017

Click herehere to see former process.

- Before processing the OOD form, notify Laura Andrews at OOD by phone or via email to verify provider's information (Tax ID, name, address, and provider status).

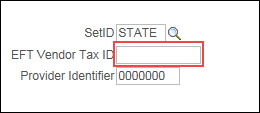

Click herehere to see former process.

- Enter

the Supplier Tax ID# in the EFT Vendor Tax

IDEFT Vendor Tax

ID field.

- The Provider

IdentifierProvider

Identifier will remain all zeros.

- Before processing the OOD form, verify with OOD by phone or via email to verify provider's information (Tax ID and name).

Revised:

- Enter the Supplier Tax ID# in the EFT Vendor Tax IDEFT Vendor Tax ID field.

- The Provider IdentifierProvider Identifier should be entered as seven zeros (0000000).

- The Provider IdentifierProvider Identifier should be entered as seven zeros (0000000).

- In the event a supplier provides multiple pieces of documentation (VIF, W9, EFT) and the zip codes do not match each other on the forms and/or vary within the OAKS system, verify which zip code is accurate by using USPS and make the necessary updates.

9/7/2017

Click herehere to see former process.

- Banking back-up will be used to confirm the routing number and account number that the supplier enters onto the EFT form or into self-registration is accurate.

- Banking back-up can consist of: voided check, sample or reorder check, deposit slip, pre-printed starter check, pre-printed counter check, direct deposit form or bank letter.

- Banking back-up will be used to confirm the account number that the supplier enters onto the EFT form or into self-registration is accurate.

- Banking back-up can consist of, but is not limited to: voided check, sample or reorder check, deposit slip, pre-printed starter check, pre-printed counter check, direct deposit form or bank letter.

8/3/2017

Click here to see former process.

Updated topic to reflect new SIF.

Revised the following:

- The Supplier Information Form can be used to establish or update a supplier record in OAKS FIN. The Supplier Information Form has been designed to

Deleted the following:

- In addition, the information contained on the W-9 form must match the information provided on the Supplier Information Form; specifically, legal business name, and taxpayer ID# (TIN).

- Click herehere for CAPA Development forms (generally sent from the Ohio Development Services Agency).

CAPA Development forms are generally sent to Supplier Operations from the agency (Ohio Development Services Agency). The documentation consists of a VIF, EFT Form, and bank verification. A Tax ID # is not required on the Supplier Information Form or EFT Form.

CAPA Development documents are to be set up as additional addresses on the supplier record (OHIO DEVELOPMENT SERVICES AGENCY Supplier # 0000000555) along with the corresponding EFT that goes with that specific address code.

- Click herehere for Treasurer of State forms (generally submitted from the agency).

-

Treasurer of State forms are very similar to CAPA Development forms. The forms will be submitted from the agency (generally). The documentation consists of a VIF, EFT form and bank verification. The Tax ID# listed on the VIF may not match the Tax ID# listed in OAKS, as OAKS has a unique Tax ID# listed. The VIF and EFT form are generally signed by the agency.

-

The documents are to be setup as additional addresses on the supplier record along with the corresponding EFT that goes with the specific address code.

-

These are to be setup as "Due Now."

-

If a bank name and number are provided on the form next to Department Name in the Address section, the bank name and number must be entered on Address Line 1 and the address must be listed on Address Line 2. When entering the bank number it should be placed within parentheses (). This is an exception to the special character rule.

-

- Click here for Escrow Agents (should be received with an Escrow Agreement).

- Incomplete forms will be returned to the supplier.

- Deleted Section 1 - Please Specify Type of Action instructions.

- Deleted the following from Section 4 - Supplier Administrator section:

- Multiple names and email addresses may be listed.

-

The contact information listed in this section is linked to the address listed in Section 3 of this form on the OAKS FIN Supplier record ContactsContacts tab.

-

"Section 5 - Payment Terms" is not required.

8/3/2017

Click here to see former process.

Updated OSS Supplier Forms website URL with the State of Ohio Suppliers website.

Revised the following

- Address Information must be a complete address (building, street number, suite or apt. number, street, city, state, and zip). This may or may not match the Supplier Information Form. If a new supplier record is being created then we will enter this address on the Address Tab. If an address is on the W9 and/or W8 that is not already listed, add the address to the supplier record as an additional address.

- Part I Taxpayer Identification Number (TIN) must be completed. The TIN must be 9 digits for both a Social Security Number (SSN) and Employer Identification Number (EIN). Both numbers may be provided but one must match the information provided. This number will be entered on the Identifying Information tab.

Deleted the following in the Part II Section - Certification

section:

- May or may not match the signature on the Supplier Information Form.

8/3/2017

Click here to see former process.

Updated OSS Supplier Forms website URL with the State of Ohio Suppliers.

Revised the following

- Banking back-up can consist of: voided check, sample or reorder check, deposit slip, pre-printed starter check, pre-printed counter check, direct deposit form or bank letter.

Deleted the followingDeleted the following:

- When there is a discrepancy between any (2) cities listed on forms and/or systems, where the street addresses and zip codes match, both street/city addresses are verified through USPS to validate that both cities listed are valid options and therefore are considered a "match" for processing. (Example: ABC St, Westerville, OH 43081 on the EFT form, but MITS and bank verification list ABC St, Columbus, OH 43081).

- If unable to confirm, refer to the "Updating the Supplier Operations Tracker" topic to reject the form(s).

- If the type of account is not listed on the "Authorization Agreement for Direct Deposit of EFT Payments" form or the bank verification, refer to the "Updating the Supplier Operations Tracker" topic to reject the form(s).

- If any other digits are missing or incorrect, refer to the "Updating the Supplier Operations Tracker" topic to reject the form(s).

- If the bank routing number is missing from ALL documentation, refer to the "Updating the Supplier Operations Tracker" topic to reject the form(s).

-

If the bank routing numbers do not belong to the same financial institution, refer to the "Updating the Supplier Operations Tracker" topic to reject the form(s).

-

If the old bank routing number is missing from the form, refer to the "Updating the Supplier Operations Tracker" topic to reject the form(s).

8/3/2017

Click here to see former process.

Added the following:

- Professional titles should be used only when followed by Inc. Corp, LLC.

- Ignore Salutations on Supplier Forms (e.g., Dr. Mary Smith, Sister Mary Smith, Pastor Mary Smith, etc.).

- Government Entities with varying naming conventions are acceptable (i.e. Trustee/Treasurer/Fiscal Officer/Finance Manager).

-

City School Districts with varying naming conventions are acceptable (i.e. School district/schools/city schools/city school district).

-

County Fairs with varying naming conventions are acceptable (i.e. County Fairs, Agricultural Societies).

Revised the following:

- The only characters that can be used in the supplier name are a dash [-] and ampersand [&] if it is used on the W-9 form.

- Click herehere for instructions on forms that contain only Lock box, drawer, file #, department #, etc. in the address.

- Zip codes may be verified and updates using USPS.

Deleted the following:Deleted the following:

- All Supplier Operations transactions in OAKS FIN must be completed using CAPITAL letters only.

- DO NOT use ANY special characters in the supplier name such as apostrophe, period, pound sign, etc. The ONLY special character used in the Supplier name is a hyphen and ampersand characters.

- DO NOT use ANY special characters (i.e., apostrophe [ ' ]; period [ . ]; hash-tag [ # ]), when entering addresses.

- If the supplier name contains "and," (e.g., John Doe and Associates), enter "and" as the ampersand character (&).

- Forms are acceptable if there is an omission of the direction prefix from the address (i.e., if the street has a North, South, East, West or combination of these before the street name in OAKS FIN, but it's not listed on the form or vice versa).

- Verify spelled out house numbers (e.g., "One East Main Street" for "1 East Main Street") with USPS. If both show as valid addresses, the numbering convention takes precedence.

- Floor or Suite # ranges are acceptable (e.g., "Suite #s 200-204").

- If the "Supplier Information Form" contains the physical street address and the Post Office Box (PO Box) address on the same address line, verify that the address in USPS combines both addresses on a single line. If they are combined in a single line in USPS, then enter the address in OAKS FIN exactly as listed in USPS. If they are not combined in USPS, then each address must be added to the supplier record as a separate address.

- Business names containing Company, Corporation, Incorporated should be abbreviated to CO, CORP, INC, etc.

- In the event a supplier provides multiple pieces of documentation (VIF, W9, EFT) and the zip codes do not match each other on the forms and/or vary within the OAKS system, verify which zip code is accurate by using USPS and make the necessary updates.

- Effective date rows can only be edited next day.

USPS Address Entry Guidelines

- United States Postal Service (USPS) look up by Zip: https://tools.usps.com/go/ZipLookupAction!input.action

- Most commonly used street abbreviations (Road should be abbreviated to RD, Drive to DR, Street to ST, Court to CT, Parkway to PKWY, etc.).

- Most commonly used unit designators:

-

- Suite should be entered as STE

- Department should be entered as DEPT

- Apartment should be entered as APT

- Building should be entered as BLDG

- Floor should be entered as FL

- Room should be entered as RM

- Do not spell out directional references for street addresses (example: 123 North Main St should be entered in OAKS as 123 N Main St.) but City & States should be spelled out (example: North Canton & South Dakota).

- US HWY must be completely spelled out as US Highway, ST RT must be completely spelled out as State Route, CR/ CNTY Rd must be spelled out as County Road, CNTY HWY must be spelled out as County Highway, TR must be completely spelled out as Township Road, etc.

- If there is a discrepancy on any forms &/or in the system where there are two different cities listed but the zip codes are the same, as long as it can be verified in USPS, either is acceptable and OAKS does not have to be updated.

- If there is a discrepancy on any forms &/or in the system when the last number of the zip code is off by 1 digit such as 43016 & 43017 either is acceptable because they are both considered Dublin, Ohio.

7/3/2017

- Manage Registration Approval

- Completing Supplier Self-Registration

Banking verification was required for all new suppliers signing up through supplier self-registration.

Bank verification is not required for new supplier EFT. Only Banking back-up is required.

Revised the following in Completing Supplier Self-Registration topic to read:

- Select the attachment File Name to view the submitted banking back-up.

- Verify the following fields displayed in the Supplier Bank Account Options section correctly match the bank account information listed on the banking back-up:

Deleted the following in Manage Registration Approval topic:

-

- For voided checks, the Name, Address, and Account Information must match.

- For other banking back-up, the Name and Account Information must match.

Added the following to Manage Registration Approval topic:

-

Routing Number and Account Number must match banking back-up.

7/3/2017

Click here for former process.Click here for former process.

Review Supplier Form

General Requirements

- Account changes must be reported to Ohio Shared Services thirty (30) days prior to the effective date of the change.

- Section 1-3 of the "Authorization Agreement for Direct Deposit of EFT Payments" must be legibly written or typed and Section 4 must include a handwritten signature.

- Bank account verification must be provided.

- To delete / inactivate EFT, no bank verification is required; however, all information on the "Authorization Agreement for Direct Deposit of EFT Payments" form must be accurate.

- If an EFT location on the supplier record has been inactive since 01/01/1901 date, the form(s) may be processed and the payment location may be updated with the new information when all other conditional requirements are also met.

Banking Verification Requirements

Bank account verification must be provided.

Revised to read:

- Bank account verification or banking back-up must be provided.

Added the following:

Banking Back-Up for New Supplier EFT Set-Up

Banking back-up must be provided for all new Supplier EFT set-up requests.

-

- Banking back-up will be used to confirm the routing number and account number that the supplier enters onto the EFT form or into self-registration is accurate.

- Banking back-up can consist of: voided check, sample or reorder check, deposit slip, starter check, counter check, direct deposit form or bank letter.

Revised to read:

Banking Verification Requirements

Bank account verification must be provided for all banking changes/updates.

6/8/2017

N/A

Added reference to topics on updating the SO Tracker.

6/8/2017

N/A

New topics added.

5/4/2017

Click herehere to see former process.

Review Supplier Forms

Verify the following documents have been received and are complete.

- Authorization

Agreement for Direct Deposit of EFT Payments and bank

account verificationbank

account verification.

- A bank communication must include the account name, the account number, and the routing number. It must also contain the bank logo/letterhead and bear the handwritten signature of a bank representative.

-

The supplier must submit a current voided check or sample to reorder check. Name, address, account number, and routing number must be pre-printed on the check (cannot be handwritten) and must match the information listed on the Direct Deposit Form and in OAKS FIN, if applicable.

-

Business checks are not required to have an address.

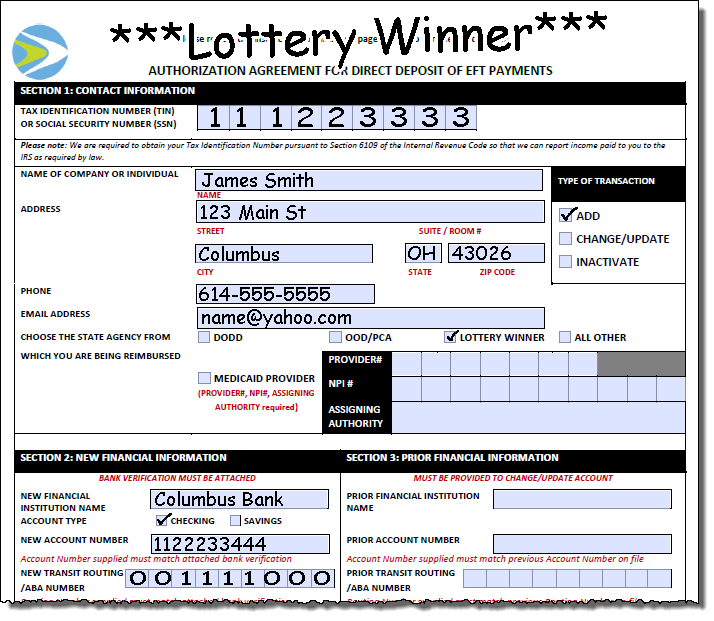

- The

Lottery

Winner formLottery

Winner form will say "Lottery

Winner" at the top or the "Lottery Winner"

checkbox is selected in Section 1.

-

The OOD formOOD form can be identified by the "OOD - PCA" checkbox in Section 1.

-

- Before processing the OOD form, notify Laura Andrews at OOD by phone or via email to verify provider's information (Tax ID, name, address, and provider status).

- Continue to the steps below once a confirmation email or phone call is received from OOD.

- In the event a supplier provides multiple pieces of documentation (SIF, W9, EFT) and the zip codes do not match each other on the forms and/or vary within the OAKS system, verify which zip code is accurate by using USPS and make the necessary updates.

Deleted the following:

-

The supplier must submit a current voided check or sample to reorder check. Name, address, account number, and routing number must be pre-printed on the check (cannot be handwritten) and must match the information listed on the Direct Deposit Form and in OAKS FIN, if applicable.

-

Business checks are not required to have an address.

-

5/4/2017

- Click herehere to see former Adding or Updating Supplier EFT Information process.

Review Supplier Forms

Verify the following documents have been received and are complete.

- Authorization Agreement for Direct Deposit of EFT Payments

-

The supplier must submit a current voided check or sample to reorder check. Name, address, account number, and routing number must be pre-printed on the check (cannot be handwritten) and must match the information listed on the Direct Deposit Form and in OAKS FIN, if applicable.

-

Business checks are not required to have an address.

- A bank communication must include the account name, the account number, and the routing number. It must also contain the bank logo/letterhead and bear the handwritten signature of a bank representative.

- In the event a supplier provides multiple pieces of documentation (SIF, W9, EFT) and the zip codes do not match each other on the forms and/or vary within the OAKS system, verify which zip code is accurate by using USPS and make the necessary updates.

-

Sole Proprietors: If the name on the “Authorization Agreement for Direct Deposit of EFT Payments” and bank verification are different, but both are reflected on the Identifying Information Tab the form(s) can be processed.

- Click herehere to see former Adding or Updating a Medicaid Provider process.

Review Supplier Forms

Ensure the following paperwork is complete:

- EFT forms for City or County School Districts (i.e., "school

district(s)," "school(s)," "city school(s),"

"city school district(s)," "school board," "board

of education," etc.) with varyingvarying

name conventions are acceptable. It is also acceptable when there

is an abbreviation (such as E.S.C.) for the "Educational Service

Center."

Variations can be between the forms and/or with the supplier record in OAKS FIN.

- The supplier must submit a current voided check or sample to reorder check. Name, address, account number, and routing number must be pre-printed on the check (cannot be handwritten) and must match the information listed on the Direct Deposit Form and in OAKS FIN, if applicable.

- Business checks are not required to have an address.

- A bank communication must include the account name, the account number, and the routing number. It must also contain the bank logo/letterhead and bear the handwritten signature of a bank representative.

- In the event a supplier provides multiple pieces of documentation (SIF, W9, EFT) and the zip codes do not match each other on the forms and/or vary within the OAKS system, verify which zip code is accurate by using USPS and make the necessary updates.

-

It is okay to process if LLC, Inc, Co. etc. are missing from the forms or the system (OAKS or MITS).

- EFT forms for City or County School Districts (i.e., "school

district(s)," "school(s)," "city school(s),"

"city school district(s)," "school board," "board

of education," etc.) with varyingvarying

name conventions are acceptable. It is also acceptable when there

is an abbreviation (such as E.S.C.) for the "Educational Service

Center."

Deleted the following:

-

The supplier must submit a current voided check or sample to reorder check. Name, address, account number, and routing number must be pre-printed on the check (cannot be handwritten) and must match the information listed on the Direct Deposit Form and in OAKS FIN, if applicable.

-

Business checks are not required to have an address.

-

- A bank communication must include the account name, the account number, and the routing number. It must also contain the bank logo/letterhead and bear the handwritten signature of a bank representative.

5/4/2017

Bank account verification must be provided.

-

Click herehere for bank account verification instructions.

- Verification must be submitted as a voided check, bank communication, or prepaid card.

- Voided Check or Sample to Reorder Check

- The supplier must submit a current voided check. Name, address, account number, and routing number must be pre-printed on the check (cannot be handwritten) and must match the information listed on the Direct Deposit Form and in OAKS FIN, if applicable.

- Bank Communication

- A formal bank communication that contains a bank logo/letterhead, customer’s name, routing number, account number and bank representative’s handwritten signature will be accepted as banking verification. Some examples include, but are not limited to the following:

- A bank letter

- Direct Deposit Enrollment Form

- Formal Bank Templates

- Any addresses referenced in the bank communication will be ignored.

- Prepaid Card

- In the case of a prepaid card, a document pre-printed from the card issuer or card issuer's website verifying account information (name on account, account and routing number) is acceptable.

- If it is a sole proprietor either the business name or individual name can be listed on the back-up document provided from the prepaid card issuer.

- Deposit slips, bank statements, non-bank letters, starter checks, and counter checks are not accepted as account verification.

Bank account verification must be provided.

-

Click herehere for bank account verification instructions.

- Verification must be submitted as a voided check, a sample to reorder check, a bank communication, or prepaid card.

-

-

Voided Check or Sample to Reorder Check

-

- The supplier must submit a current voided check or sample to reorder check. Name, address, account number, and routing number must be pre-printed on the check (cannot be handwritten) and must match the information listed on the Authorization Agreement for Direct Deposit of EFT Payments and in OAKS FIN, if applicable.

- Bank Communication

-

-

-

-

A bank communication must include the account name, the account number, and the routing number. It must also contain the bank logo/letterhead and bear the handwritten signature of a bank representative.

-

Any addresses referenced in the bank communication will be ignored.

-

- Prepaid Card

-

- In the case of a prepaid card, a document pre-printed from the card issuer or card issuer's website verifying account information (account name, account number, and routing number) is acceptable.

- If it is a sole proprietor either the business name or individual name can be listed on the back-up document provided from the prepaid card issuer.

-

- Deposit slips, non-bank letters, starter checks, and counter checks are not accepted as account verification.

- Business checks are not required to have an address.

- Sole Proprietors: If the name on the Authorization Agreement for Direct Deposit of EFT Payments and bank verification are different, but both names are reflected on the Identifying Information Tab, the forms can be processed.

4/3/2017

- Manage Registration Approval

- Review Registration History Page

- Completing Supplier Self-Registration

New topics added.

03/09/2017

-

If a complete and accurate "Authorization Agreement for Direct Deposit of State Warrants (OBM 4310)Authorization Agreement for Direct Deposit of State Warrants (OBM 4310)" is received, click here and complete the steps to enter EFT information.

-

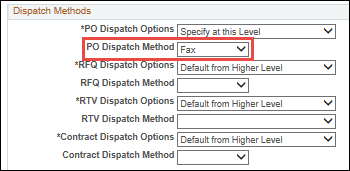

Complete the following steps for "FAX" or "EMAIL" Locations.

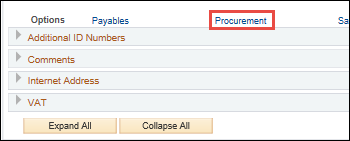

- Click the ProcurementProcurement link.

- The Procurement OptionsProcurement Options page displays.

- The Procurement OptionsProcurement Options page displays.

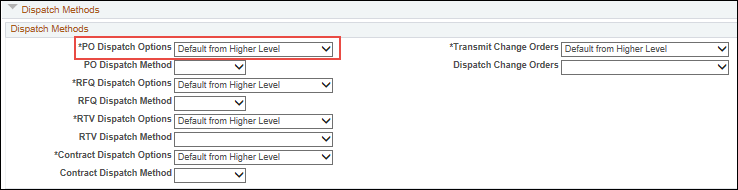

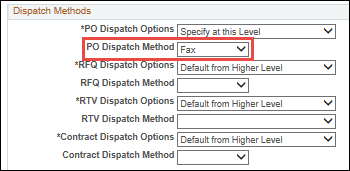

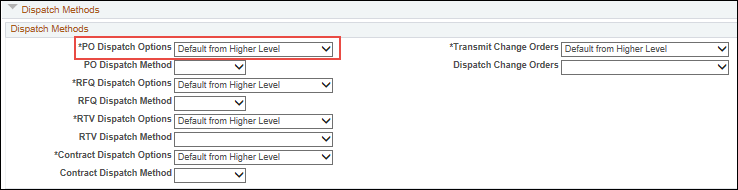

- Click Dispatch MethodsDispatch Methods to expand the section.

- Click the PO Dispatch OptionsPO Dispatch Options dropdown and select "Specify at this Level."

- Click the PO Dispatch MethodPO Dispatch Method dropdown and select "Email" or "Fax" (based on the Location).

- Click the ProcurementProcurement link.

New steps for populating purchase card acceptance fields:

- If a complete and accurate "Authorization Agreement for Direct Deposit of State Warrants (OBM 4310)Authorization Agreement for Direct Deposit of State Warrants (OBM 4310)" is received, click here and complete the steps to enter EFT information.

- Click the ProcurementProcurement link.

-

The Procurement OptionsProcurement Options page displays.

-

Complete the following steps for "FAX" or "EMAIL" Locations.

- Click Dispatch MethodsDispatch Methods to expand the section.

- Click the PO Dispatch OptionsPO Dispatch Options dropdown and select "Specify at this Level."

- Click the PO Dispatch MethodPO Dispatch Method dropdown and select "Email" or "Fax" (based on the Location).

- Click Dispatch MethodsDispatch Methods to expand the section.

-

Click Procurement Card InformationProcurement Card Information to expand the section.

-

Click Accepts Procurement Card as payment methodAccepts Procurement Card as payment method.

-

Select "Visa" from the Card TypeCard Type dropdown.

-

Click OK.

2/9/2017

2/9/2017

- Click the Payment Terms OptionsPayment Terms Options dropdown and select "Specify."

- Select the Look Up Payment Term IDLook Up Payment Term ID icon.

- Select the applicable payment terms:

- State Employee = "00 Due Now" or

- Individual = the pay terms as marked on the "Supplier Information Form"

- For State Employee:

- Click the Payment Terms OptionsPayment Terms Options dropdown and select "Specify."

- Click the Look Up Payment Term IDLook Up Payment Term ID icon and select "00 Due Now."

- For Individual:

- Click the Payment Terms OptionsPayment Terms Options dropdown and select Default from higher level.

- Click the Payment Terms OptionsPayment Terms Options dropdown and select Default from higher level.

2/9/2017

Click here to see former process.

Deleted the following:

- Click the ProcurementProcurement link.

- The Procurement OptionsProcurement Options page displays.

- The Procurement OptionsProcurement Options page displays.

- Click Additional Procurement OptionsAdditional Procurement Options to expand the section.

- Click the Payment Terms OptionsPayment Terms Options dropdown and select "Specify."

- Click the Look up Payment Term IDLook up Payment Term ID icon and select "Due Now."

- Click OKOK.

- The Location tab displays again.

2/9/2017

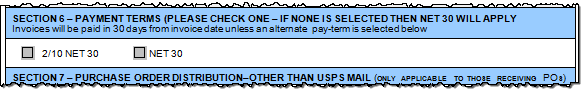

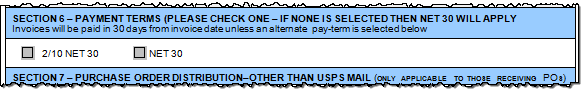

Deleted the following:

- Click Additional Procurement OptionsAdditional Procurement Options to expand the section.

- Click the Payment Terms OptionsPayment Terms Options dropdown.

- Select Specify or leave as Default whenwhen:

-

-

- "Net 30" is specified on

"Section

6Section

6 - Payment Terms"

of the "Supplier Information Form."

- No Payment Terms are specified on

"Section

6Section

6 - Payment Terms"

of the "Supplier Information Form."

- If a Payment Term other than one of

the options provided is handwritten on

"Section

6Section

6 - Payment Terms"

of the "Supplier Information Form."

- If more than one Payment Term is selected

on "Section 6Section 6

- Payment Terms" of

the "Supplier Information Form."

- "Net 30" is specified on

"Section

6Section

6 - Payment Terms"

of the "Supplier Information Form."

-

-

- Select Specify if none of the above.

- Select Specify or leave as Default whenwhen:

- Select the Look Up Payment Term IDLook Up Payment Term ID icon.

-

Select Payment Term IDPayment Term ID from the dropdown list.

- Select "2/10 Net 30" if specified on "Section 6Section 6 - Payment Terms" of the "Supplier Information Form" and the supplier does not fall into the one of the categories below.

- Select "Due Now" for state employees, business unit suppliers, and CAPA Development.

- Select "Net 30" or leave blank (if Payment Terms Flag is "Default") for the following:

-

- "Net 30" is specified

- No Payment Terms are specified on "Section 6Section 6 - Payment Terms" of the "Supplier Information Form."

- If a Payment Term other than one of the options provided is handwritten on "Section 6Section 6 - Payment Terms" of the "Supplier Information Form."

- If more than one Payment Term is selected on "Section 6Section 6 - Payment Terms" of the "Supplier Information Form."

- "Net 30" is specified

- Select "2/10 Net 30" if specified on "Section 6Section 6 - Payment Terms" of the "Supplier Information Form" and the supplier does not fall into the one of the categories below.

2/9/2017

Supplier Payment Terms

Deleted topic.

12/08/2016

N/A

- Provinces should be abbreviated.

Replaced the following URL:

- Refer to the USPS International Addressing Tips for additional guidelines.

11/14/2016

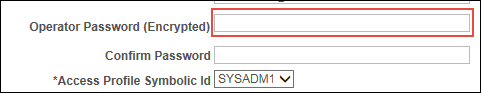

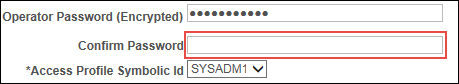

- Enter a password in the Operator Password (Encrypted)Operator Password (Encrypted) field.

- Re-enter password in the Confirm PasswordConfirm Password field.

11/14/2016

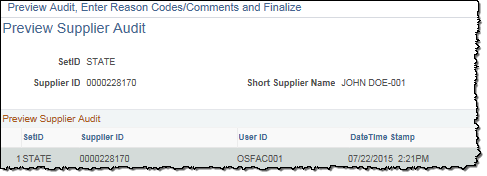

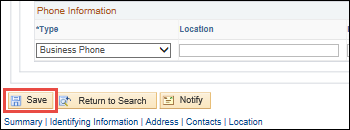

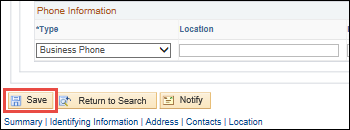

- Click SaveSave.

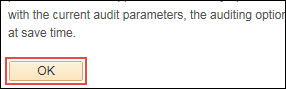

- The Preview Supplier AuditPreview Supplier Audit page displays an audit of the changes made to the suppliers account.

- The Preview Supplier AuditPreview Supplier Audit page displays an audit of the changes made to the suppliers account.

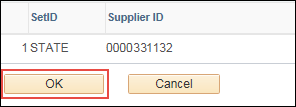

- Click OKOK.

- If any other updates are to be made (e.g., contacts, pay terms, etc.), refer to the applicable topic before proceeding to the Summary tab.

- Click SaveSave.

-

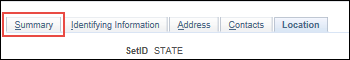

- If any other updates are to be made (e.g., contacts, pay terms, etc.), refer to the applicable topic before proceeding to the Summary tab.

- If all necessary updates have been made, click the SummarySummary tab and proceed to the Summary tab instructions below.

11/14/2016

N/A

Added the following to the "Searching for Supplier" section:

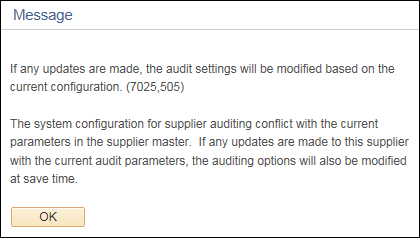

- A MessageMessage window may display.

- Click the OKOK button.

- Click the OKOK button.

11/14/2016

N/A

Added the following:

- After conducting a search, click the Recent Search ResultsRecent Search Results icon at the end of the breadcrumb navigation anytime to display the Recent Search Results in a pop-up window.

11/3/2016

N/A

Added the following:

- Click here for Disregarded Entities.

10/6/2016

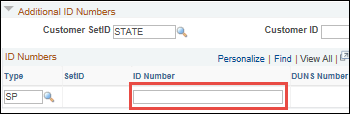

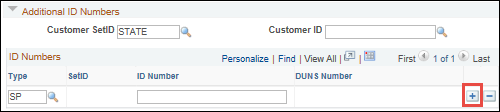

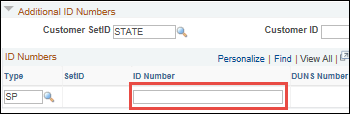

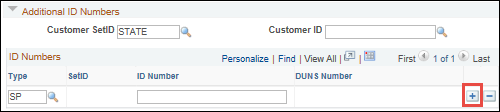

Click herehere if the following is provided on the "IRS Form W-9": Business name, individual name (optional), "Individual / sole proprietor" federal tax classification, and Social security numberSocial security number OR Employer Identification Number.

If SSN is provided on the W-9, the individual name must be provided in addition to the business name.

- Select Type "SP - Sole Proprietor."

- Leave ID NumberID Number

field blank in the "SP" line.

- Click the Add a New RowAdd a New Row

icon.

- Select TypeType

"TIN - TIN/SSN" in the second line.

- Select Type "SP - Sole Proprietor."

- Leave ID NumberID Number

field blank in the "SP" line.

- Click the Add a New RowAdd a New Row

icon.

- Select TypeType

"TIN - TIN/SSN" in the second line.

If SSN is provided on the W-9, the individual name must be provided in addition to the business name.

10/6/2016

Click here to see former process.

- Revised the following Federal Tax Classification table.

- Click herehere for guidelines.

Federal Tax Classification (W-9)

Type (OAKS)

ID Number (OAKS)

Type of Contractor (OAKS)

Individual TIN Social Security or Employer Identification Social Security or Tax Identification Sole Proprietor/ Single Member LLC SP & TIN Social SecuritySocial Security or Employer Identification If Social security number is provided, the individual name and company name must be provided on the W-9.

Social Security or Tax Identification C CORP / S CORP TIN Employer Identification Corporation Partnership TIN Employer Identification Tax Identification Trustee / Estate TIN Employer IdentificationEmployer Identification An estate should have an EIN if the payments are related to income earned by the deceased's possessions (e.g., rental income). An estate can use a SSN if it is for money owed directly to the deceased for wages or services they provided while alive.

Social Security or Tax Identification Limited Liability (LLC)Limited Liability (LLC) *C CORP = Corporation

*S CORP = Corporation

*Partnership = Tax Identification

TIN Employer Identification Tax Identification or Corporation Other - NonprofitNonprofit May be listed as "Public Charity," "501(3)(c)," etc.

TIN Employer Identification Corporation Other - Association TIN Employer Identification Tax Identification Other - Government EntityGovernment Entity May indicate "Municipal Corporation."

TIN Employer Identification Government Entity Other - State Business Unit/Agency - No W-9 Required

TIN 00<Agency Acronym>0000 (If provided) State Agency HCM screen shots - No W-9 RequiredHCM screen shots - No W-9 Required See employee set-up.

TIN State Employee Identification State Employee

9/8/2016

N/A

-

Added the following to the "Section 8 - Please Sign & DateSection 8 - Please Sign & Date" section:

-

Do not accept Font signatures.

9/8/2016

For updates the new address must be listed on the Supplier Information Form (SIF) and the address to be replaced must be listed in Section 1 of the Supplier Information Form (SIF).

If an address is on the W9 and/or W8 that is not on the Supplier Information Form, add the address to the supplier record as an additional address.

8/4/2016

N/A

Updated the USPS International Addressing Tips URL address.

8/4/2016

N/A

Added the following concerning Supplier Forms that require signature:

-

Do not accept signature if you can click on the signature and move it around the page.

-

Do not accept signature if there are black lines around it indicating use of a rubber stamp.

8/4/2016

N/A

Revised steps on Updating/Replacing a supplier's address in the Review Supplier Forms section:

- The address to be replaced must be listed in Section 1 of the Supplier Information Form.

- If an address is on the W9 that is not on the Supplier Information Form, add that address to the supplier record as an additional address.

8/4/2016

Click here to see former process.

- Revised Instructions for updating Box 5: Permanent residence address, City or town, state or province section to read:

- For updates the new address must be listed on the Supplier Information Form and the address to be replaced must be listed in Section 1 of the Supplier Information form.

- Revised Instructions for updating Box 6: Business address in the United States, City or town, state, and ZIP code section to read:

- For an update the address to be replaced must be listed in Section 1 of the Supplier Information form.

8/4/2016

Click here to see former process.

Revised the Supplier Information section to read:

- For updates the new address must be listed on the Supplier Information form and the address to be replaced must be listed in Section 1 of the Supplier Information form.

8/4/2016

Revised the process of searching for open supplier transactions by using the OH_AP_UNPAID_VOUCHERS_SUPPLIER query.

8/4/2016

N/A

Added the following to "Review Supplier Forms" section:

- Business checks are not required to have an address.

7/12/2016

Deleted the following:

- When updating address or EFT for government entities, school districts, democratic & republican parties, and fire departments - email notification must be sent to Department of Taxation: Brandon.Carbaugh@tax.state.oh.us.

5/5/2016

- When change request is submitted (for an update or additional address) and a Supplier Information Form (OBM-5657) is received with a DBA name listed, both supplier records are updated: (the parent company and the DBA).

- The backup documentation may only contain the DBA name, but both the registered name and the DBA are updated since they are the same entity doing business with more than one name and sharing the same TIN.

5/5/2016

- When entering a provider name into the Maintain side of OAKS FIN the name must be entered exactly how it appears in MITS.

4/18/2016

- A formal bank communication that contains a bank logo/letterhead, customer’s name, routing number, account number and bank representative’s handwritten signature will be accepted as banking verification.

4/18/2016

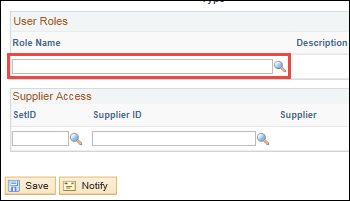

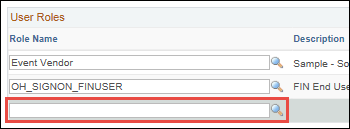

-

Click here to view former process.

Revised the following to read "vendor" instead of "supplier."

- Click the Look Up Role NameLook Up Role Name icon and select "EVENT Vendor."

- Click the Look Up Role NameLook Up Role Name icon and select "OH_ES_VENDOR_ADMIN."

-

The OH_ES_VENDOR_ADMIN role will give users access to the eSupplier Portal as the administrator.

-

4/18/2016

- N/A

Added the following:

-

If the individual name is listed along with the business name and the Federal Employer ID #is provided, the individual name will be ignored and the supplier will be set up under the company name.

4/18/2016

- For a new entry, both supplier name(s) and TIN must match the information listed on the "IRS Form W-9" or "IRS Form W-8."

- For an existing Supplier, the name and Tax ID must match the information listed on the Supplier Identifying Information tab in the OAKS FIN Supplier module.

Reworded the following to read:

- For a new Supplier, supplier name(s) and TIN listed on the Supplier Information Form must match the information listed on the "IRS Form W-9" or "IRS Form W-8."

- For an existing Supplier, the name and Tax ID listed on the Supplier Information Form must match the information listed on the "IRS Form W-9 or "IRS Form W-8."

Added missing hyperlink:

-

Click here for Escrow Agents (should be received with an Escrow Agreement).

4/18/2016

-

N/A

Added the following to the Government Entities/Municipalities section:

-

Can also be signed by Judge/Deputy Clerk.

-

For municipalities the address on bank verification is not required for process.

Added the following to the Prepaid Card section.

-

- If it is a sole proprietor either the business name or individual name can be listed on the back-up document provided from the prepaid card issuer.

4/18/2016

- N/A

-

For sole proprietor businesses enter the name is in the Supplier Name field and enter the Individual’s name in the Additional Name field.

Added "Single Member LLC" to the Federal Tax Classification table.

| Sole Proprietor/ Single Member LLC | SSN OR EIN | Social Security or Tax Identification |

4/18/2016

-

Forms are acceptable if there is an omission of Inc., Corp, LLC, Company/Co, or LLP from the supplier name.

Revised the following to read:

- It is okay if Inc., Corp, LLC, Company/CO, LLP, etc., are missing from the forms and/or the system (OAKS FIN and/or MITS).

4/18/2016

- Click here to view former process.

Deleted the following from steps on updating the Supplier Bank Accounts information.

- Enter Bank IDBank ID with the "Transit Routing / ABA Number" provided on the "Authorization Agreement for Direct Deposit of EFT Payments" form or as instructed by RACM.

4/18/2016

- Click here to view former process.

Deleted the following from steps on updating Bank section:

- Update Bank ID field with the verified "Transit Routing/ABA Number" provided.

Deleted the following:

- When updating address or EFT for government entities, school districts, democratic and republican parties, and fire departments, send an email notification to Department of Taxation: Brandon.Carbaugh@tax.state.oh.us.

Added the following:

- Sole Proprietors: If the name on the “Authorization Agreement for Direct Deposit of EFT Payments” and bank verification are different, but both are reflected on the Identifying Information Tab the form(s) can be processed.

4/18/2016

- Click here to view former process.

- When entering a provider name into the Maintain side of OAKS the name must be entered exactly how it appears in MITS.

Added the following:

- EFT forms for City or County School Districts (i.e., "school district(s)," "school(s)," "city school(s)," "city school district(s)," "school board," "board of education," etc.) with varyingvarying name conventions are acceptable. It is also acceptable when there is an abbreviation (such as E.S.C.) for the "Educational Service Center."

Variations can be between the forms and/or with the supplier record in OAKS FIN.

Added the following:

- It is okay if Inc., Corp, LLC, Company/CO, LLP, etc., are missing from the forms and/or the system (OAKS FIN and/or MITS).

Revised the following in the "Adding or Updating Medicaid Provider EFT Information" section to read "Provider Name" instead of "Supplier Name."

- Enter or update the OAKS FIN Provider Name in the Vendor NameVendor Name field.

Deleted the following:

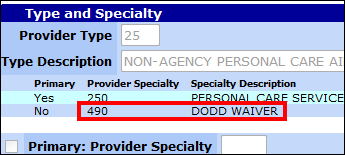

- The Type and Specialty screen contains the type of services provided.

-

- Provider Specialty code "490" is on the regular side.

-

- If the Provider SpecialtyProvider Specialty code is "490," do not proceed with the steps on this topic. Refer to the "Adding or Updating Supplier EFT Information" topic to set up the DODD provider as a regular supplier in OAKS FIN.

- If the Provider SpecialtyProvider Specialty code is "490," do not proceed with the steps on this topic. Refer to the "Adding or Updating Supplier EFT Information" topic to set up the DODD provider as a regular supplier in OAKS FIN.

- All other Provider Specialty codes are on the Maintain side.

- The provider listed below is an example of Specialty Type 250 - Personal Care Services. This provider is Medicaid only and would only be added on the Maintain side.

- This provider has multiple specialty types and has to be set up in OAKS FIN on both the Maintain side (Medicaid Providers) and the Regular Side (DODD Providers).

1/15/2016

- N/A

- "Authorization Agreement for Direct Deposit" forms prior to September 2009 will not be accepted and will be returned to the supplier and/or agency.

11/18/2015

- N/A

- Clear the CountyCounty field.

- Clear the Email, Telephone, and Fax fields.

11/5/2015

- N/A

- For ODOT Right of Ways refer to Right of Ways.

- Supplier forms for City or County School Districts (i.e., "school district(s)," "school(s)," "city school(s)," "city school district(s)," "school board," "board of education," etc.) with varyingvarying name conventions are acceptable. It is also acceptable when there is an abbreviation (such as E.S.C.) for the "Educational Service Center."

Variations can be between the forms and/or with the supplier record in OAKS FIN.

11/5/2015

- Adding a New Supplier

- Understanding Supplier Forms

- Updating Supplier Information

- Adding a Petty Cash Supplier

- Adding a Regular Supplier

- Adding a State Employee Supplier

- If information provided on the supplier form(s) is unclear and/or conflicting, use any additional backup documentation to assist with processing (e.g., coversheets, emails, websites, etc.)

- f the supplier name is conflicting on the forms, backup documentation, and/or OAKS FIN due to the adding or deleting of the letter "s" to make a word plural, singular, or possessive (e.g., enterprise / enterprises), use additional resources such as a phone call, Secretary of State website, supplier website, etc. to confirm the supplier name.

- If the supplier name has spelling discrepancies on the forms, backup documentation and/or OAKS FIN, use additional resources such as a phone call, Secretary of State website, supplier website, etc. to confirm the supplier name and note the results on the Supplier Operations Tracker Comments.

- If information provided on the supplier form(s) is unclear and/or conflicting, use any additional backup documentation to assist with processing (e.g., phone calls, coversheets, emails, Secretary of State website, websites, etc.). Note the results on the Supplier Operations Tracker.

11/5/2015

- N/A

Added:

Supplier Portal Overview

Once a supplier registers to do business with the State of Ohio and is approved by the State, the supplier will be given login credentials to log into the Ohio Supplier Portal Sign-On Page. The Supplier Portal is a self-service module that provides suppliers access to view the real-time status of their purchase orders, invoices and payment information in a read-only portal. The Ohio Supplier Portal Sign-On Page is a one-stop-shop where suppliers will navigate to sign into OAKS FIN. Features and help desk information are also provided for user reference. The Ohio Supplier Portal Website provides helpful information and training materials for current and new suppliers.

The following features are accessible through the Ohio Supplier Portal:

-

eSupplier

-

Review supplier information.

-

Review invoices, payments, and purchase orders.

-

Create new supplier users.

11/5/2015

- N/A

Added:

- Click the Add a new row icon in the User Roles section.

- Click the Look Up Role Name icon and select "OH_ES_VENDOR_USER."

-

- The OH_ES_VENDOR_USER role will give users access to the eSupplier Portal.

11/5/2015

Throughout all topics

- N/A

- The Vendor Maintenance Tracker is now referred to as the Supplier Operations Tracker.

- The Vendor Maintenance team is now referred to as the Supplier Operations team.

- All references of "vendor" were replaced with "supplier" (where applicable).

11/5/2015

- N/A

-

Effective date rows can only be edited next day.

11/5/2015

- N/A

- Added new topic.

11/5/2015

- N/A

- All supporting documentation related to supplier banking information must be attached to the supplier record on the Location tab.

-

- Acceptable form formats include JPEG, PDF and TIF.