IRS Tax Levies

A levy is a legal seizure of property to satisfy a tax debt. An individual's

wages, salary and other income can be levied. Wages, salary, and other

income include payment for personal services in a work relationship.

Processing the IRS Notice of Levy

The IRS Notice of Levy, Form 668-A(ICS)IRS Notice of Levy, Form 668-A(ICS)

is submitted to OBM to place a hold on the supplier record in OAKS FIN.

OBM State Accounting receives the "Notice of Levy" form, and

completes and mails the appropriate sections to the Supplier. State Accounting

will send the forms to supplier@ohio.gov. This topic outlines the steps

to process the "Notice of Levy" forms from the OSS Supplier

Operations tracker.

Completing the "Notice of Levy"

- Refer to the search instructions in the

Reviewing

Supplier Information topic to locate the supplier record in OAKS

FIN.

- Levies are added to any DBAs associated

with the Tax ID, in addition to the parent company.

Updating the Supplier Operations Tracker

Updating the Supplier Record with a Hold Payment

Place all "CHK" and "EFT" locations for the supplier

on hold and update the payment handling to "LI."

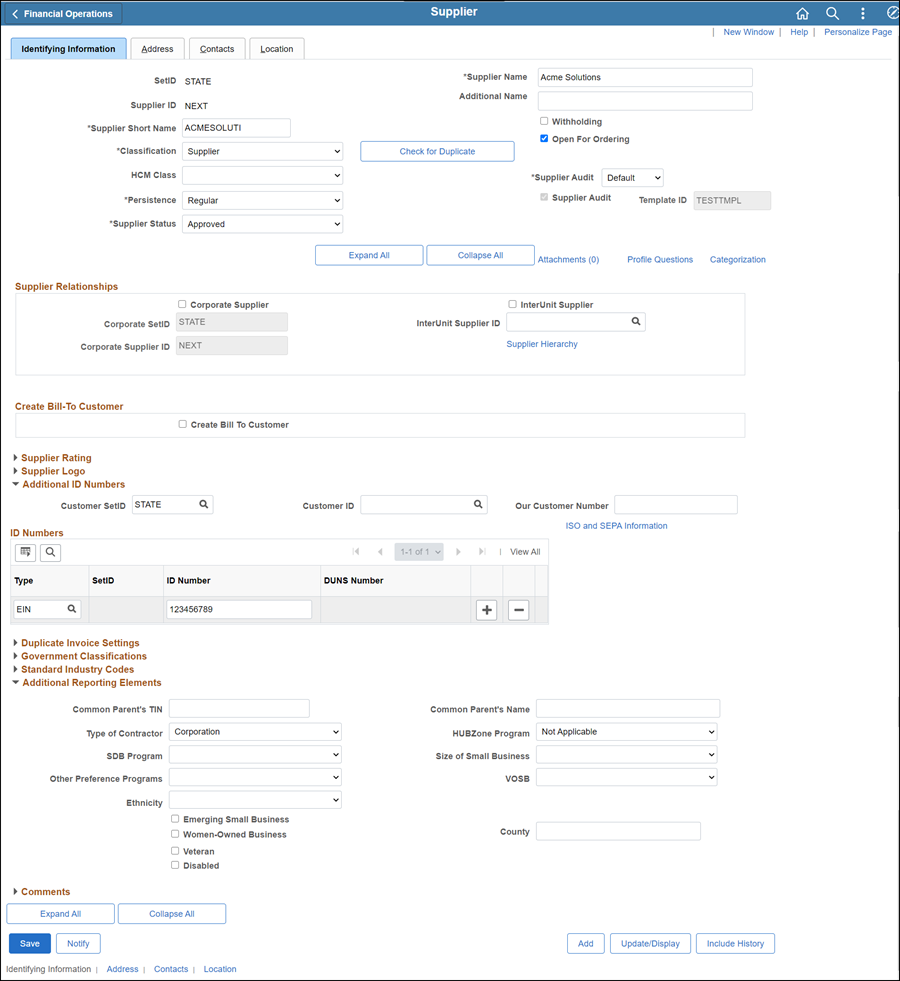

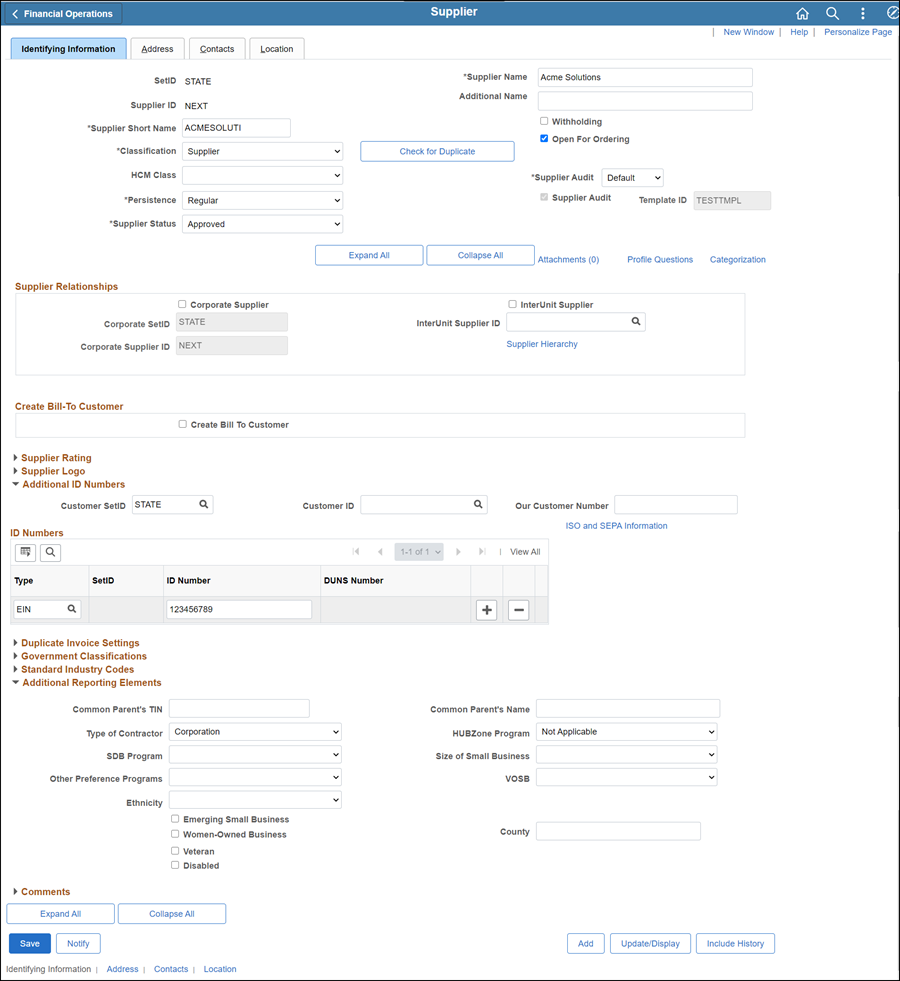

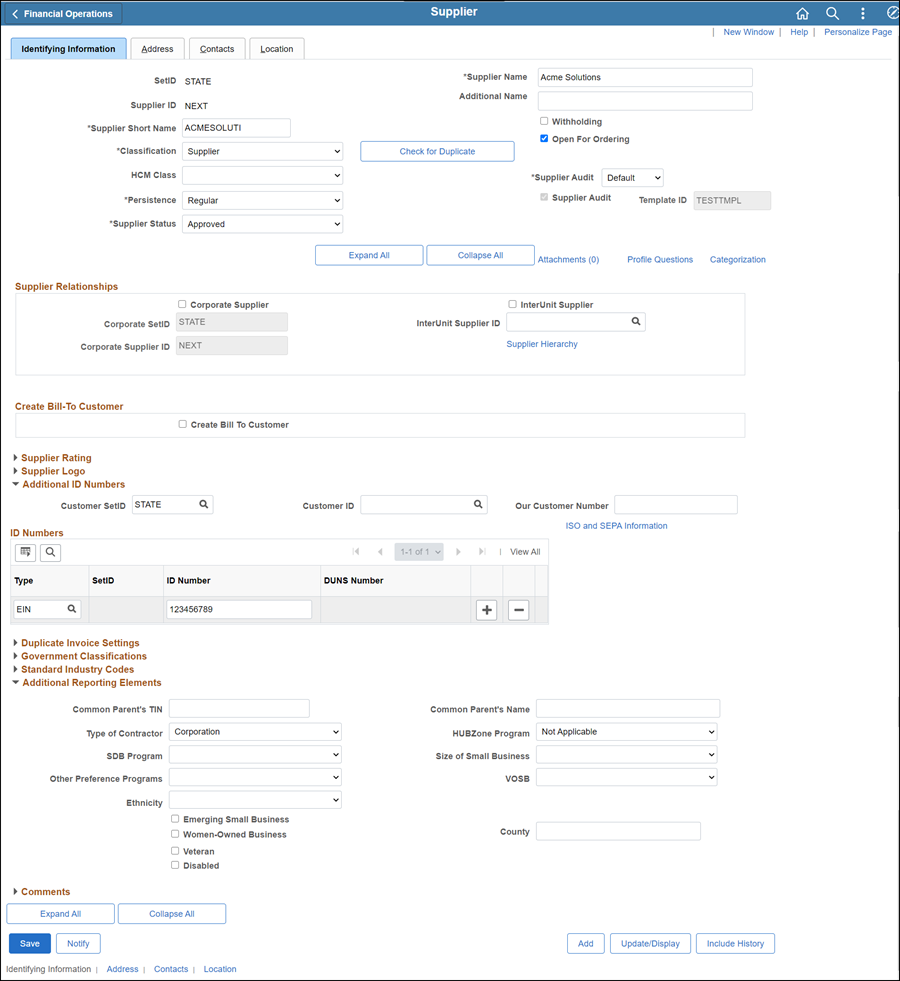

- Click the Identifying Information tab.

- All supporting documentation must be attached

to the supplier's record on the Identifying

Information tab.

- Acceptable form formats include JPEG,

PDF and TIF.

Click herehere

for instructions on attaching supporting documentation to the supplier

record.

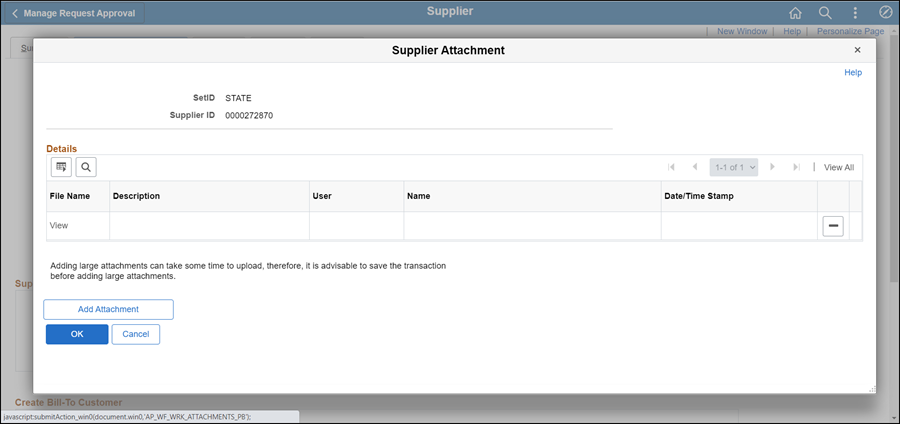

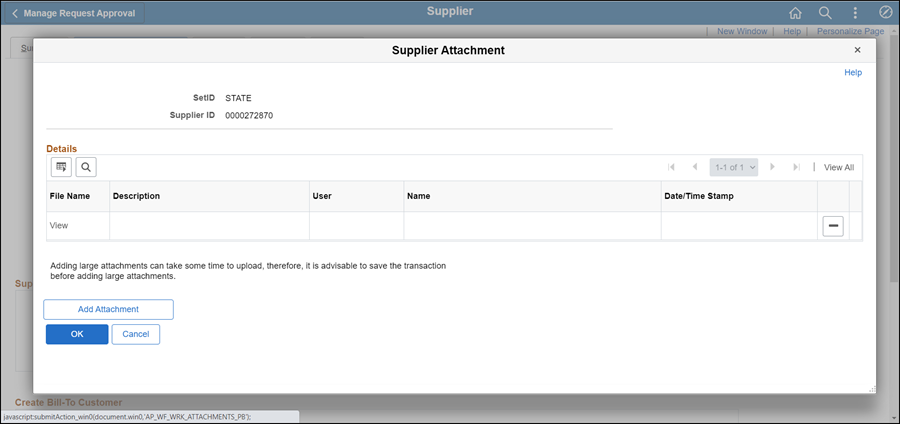

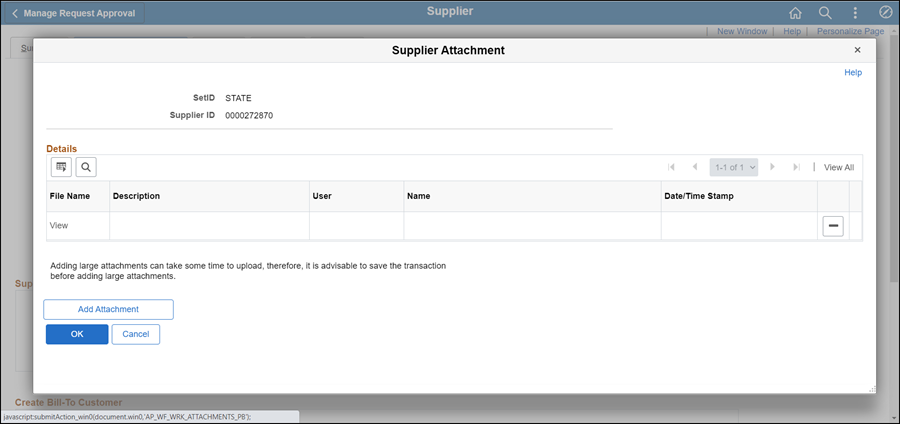

- Click the Attachments

link.

- The Supplier Attachment

page displays.

- Click Add Attachment.

- Copy the Document URL

from the Supplier Operations Tracker.

- Click Browse.

- Paste the Document

URL into the File

name.

- Click Open.

- Click Upload.

- The Supplier Attachment

page displays.

Update Description

with <descriptive name of the document> (e.g., "VIF

W9 EFT").

Click OK.

- The Identifying

Information tab displays.

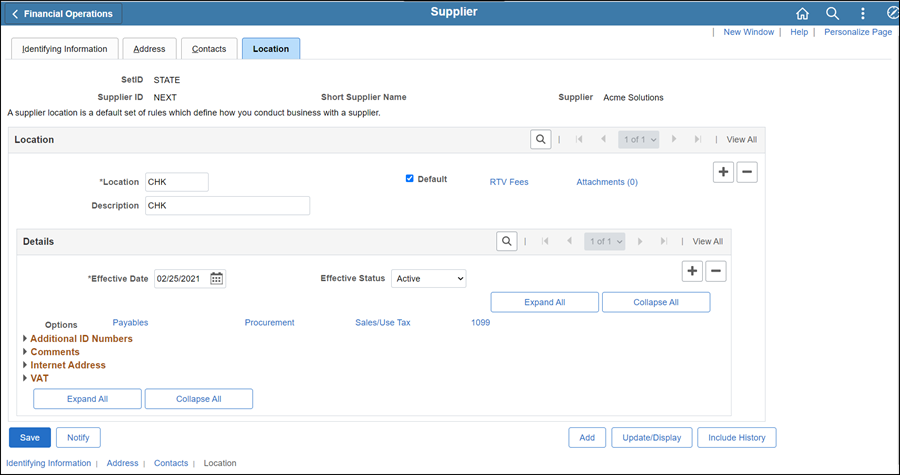

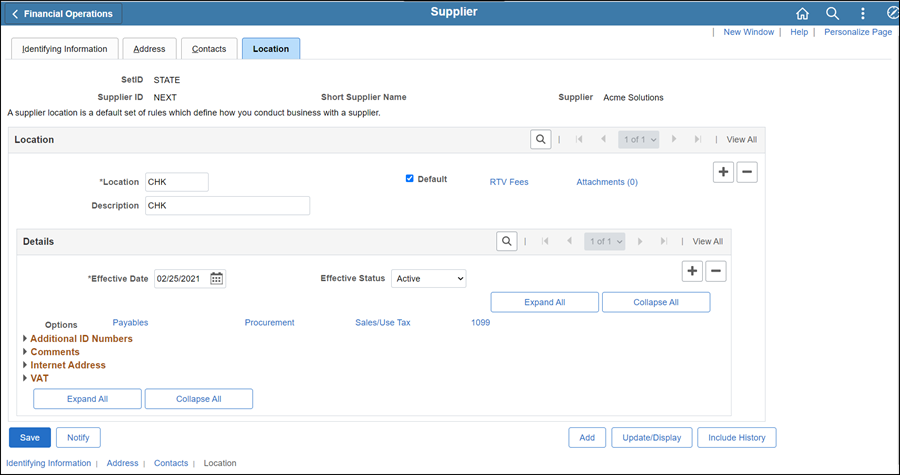

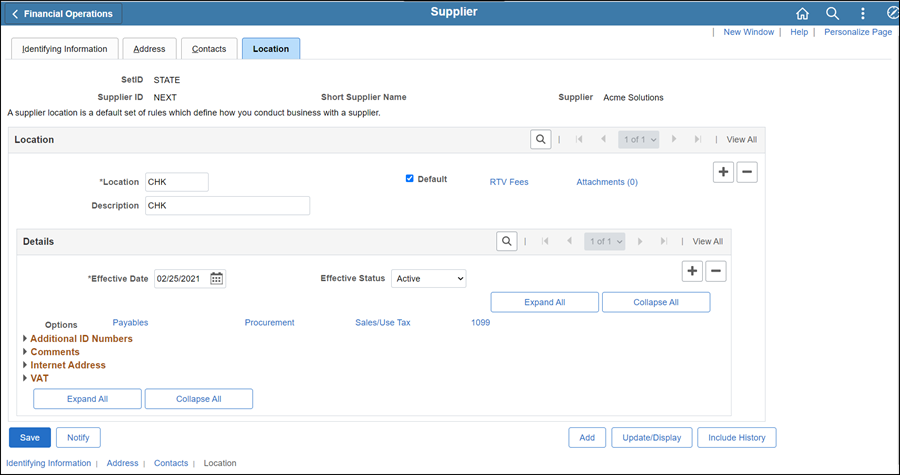

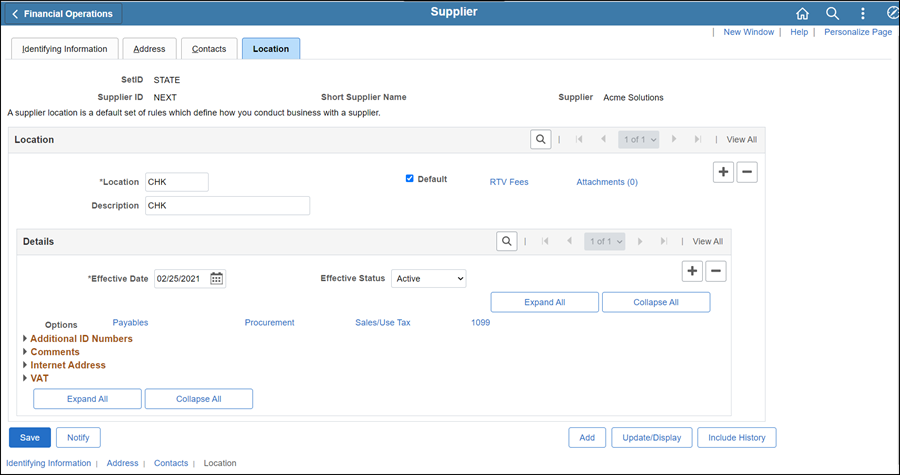

- Click the Location tab.

- Click the Add a New

Row icon in the Details

section to add an effective dated row.

- Click the Payables link.

- Click on Additional

Payables Options to expand the section.

- In the Payment Control

section, click the Hold

Payment checkbox.

- In the Additional Payment Information

section, select "Specify at this level" from the

Handling Options dropdown.

- Update the Handling

field to "LI."

- Click OK.

- The Location

tab displays.

- Click on Comments

to expand the section.

- In the Comment

section add "IRS NOTICE OF LEVY. PLEASE CONTACT STATE ACCOUNTING-PAYMENT

ISSUANCE AT OBM.PAYMENTISSUANCE@OBM.OHIO.GOV" with the date and

the associate's initials.

- Repeat the above steps on all EFT locations,

if applicable.

- Create an additional location

called "OBM ONLY" (this location does not have a hold or

LI handling code).

- Click the Add

a New Row icon in the Location

section.

- Enter Location

"OBM ONLY."

- Enter Description

"OBM ONLY."

- Click Save.

- The Preview Supplier

Audit page displays an audit of the changes made

to the suppliers account.

- Click OK.

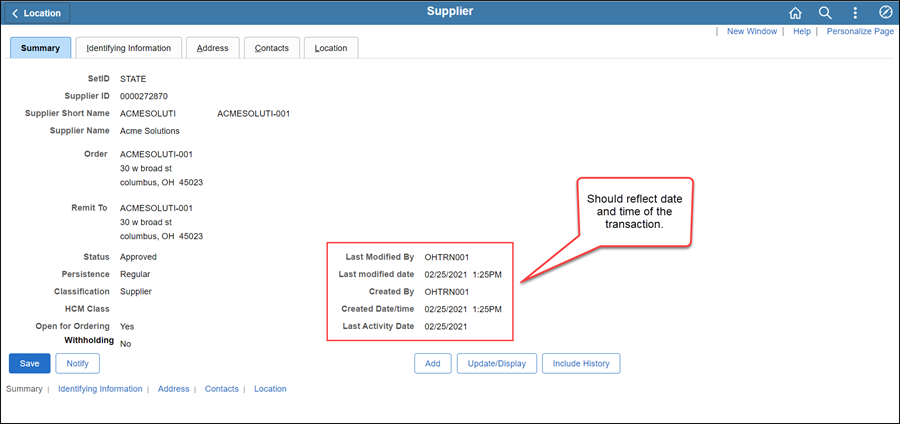

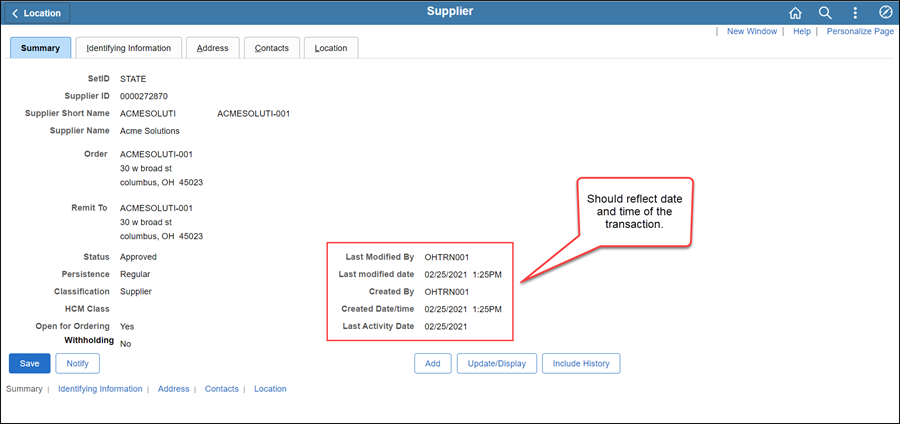

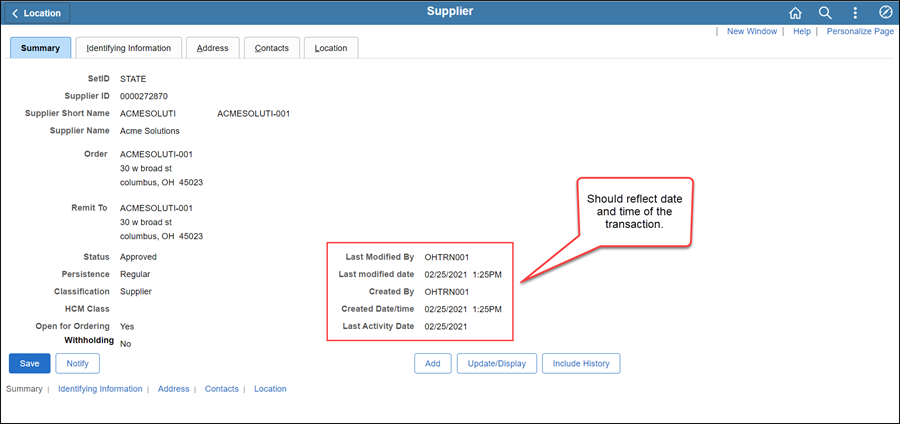

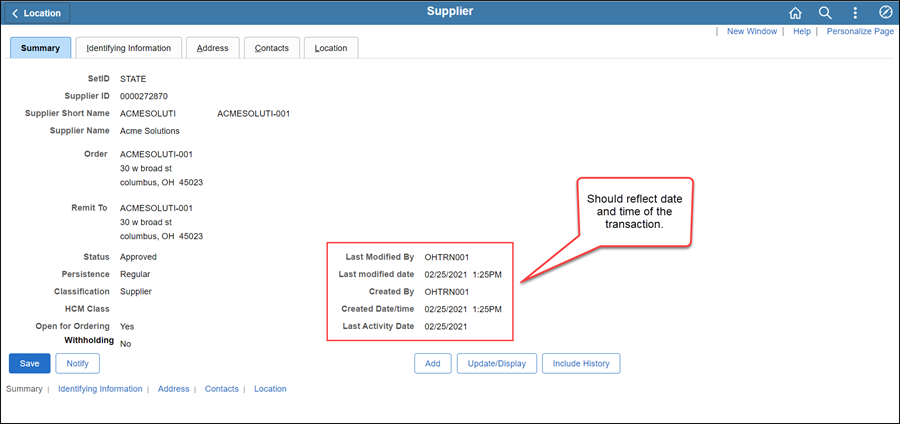

- Click the Summary

tab.

Summary tab

The supplier file Summary tab

provides an overview of the supplier record.

Once all updates have been made to the supplier record, review

the Summary tab to

verify that the record was modified.

Processing the Release of Levy

When the "Levy Release Notice"

is received by OBM State Accounting, it will be sent to supplier@ohio.gov

to be uploaded to the Supplier

Operations Tracker.

Updating the Supplier Operations Tracker

- Refer to the "Searching the Supplier

Operations (SO) Tracker" topic and follow the steps to locate

the "Levy Release Notice" work item.

- Refer to the "Assigning SO Work Items"

topic and follow the steps to assign the "Levy Release Notice"

work item.

- Refer to the "Labeling the Supplier

Operations Tracker" topic and follow the steps to label the

"Levy Release Notice" work item.

Updating the Supplier Record with the Release

Remove the hold and LI from all "CHK"

and "EFT" locations on the supplier record.

- Click the Identifying Information tab.

- All supporting documentation must be attached

to the supplier's record on the Identifying

Information tab.

- Acceptable form formats include JPEG,

PDF and TIF.

Click herehere

for instructions on attaching supporting documentation to the supplier

record.

- Click the Attachments

link.

- The Supplier Attachment

page displays.

- Click Add Attachment.

- Copy the Document URL

from the Supplier Operations Tracker.

- Click Browse.

- Paste the Document

URL into the File

name.

- Click Open.

- Click Upload.

- The Supplier Attachment

page displays.

Update Description

with <descriptive name of the document> (e.g., "VIF

W9 EFT").

Click OK.

- The Identifying

Information tab displays.

- Click the Location tab.

- Click the Add a New

Row icon in the Details

section to add an effective dated row.

- Click the Payables link.

- Click on Additional

Payables Options to expand the section.

- In the Payment Control section, uncheck

the Hold Payment

box.

- In the Additional Payment Information section,

select "Default from Higher Level" from the Handling Options dropdown.

- Remove "LI" from the Handling

field.

- Click OK to

return to the Location

tab.

- Click on Comments

to expand the section under the "CHK" location.

- Create a new comment with

the date to reflect release of levy.

- Navigate to the "OBM Only" location

- Click the Add a New

Row icon in the Details

section to add an effective dated row.

- Select Inactive for the

"OBM ONLY" location.

- Click Save.

Click the Summary

tab.

Summary tab

The supplier file Summary tab

provides an overview of the supplier record.

Once all updates have been made to the supplier record, review

the Summary tab to

verify that the record was modified.

Next steps - Updating the Supplier Operations

Tracker

Next steps - Updating the Supplier Operations

Tracker

Next steps - Updating the Supplier Operations

Tracker

Next steps - Updating the Supplier Operations

Tracker