Effective: 10/04/2018

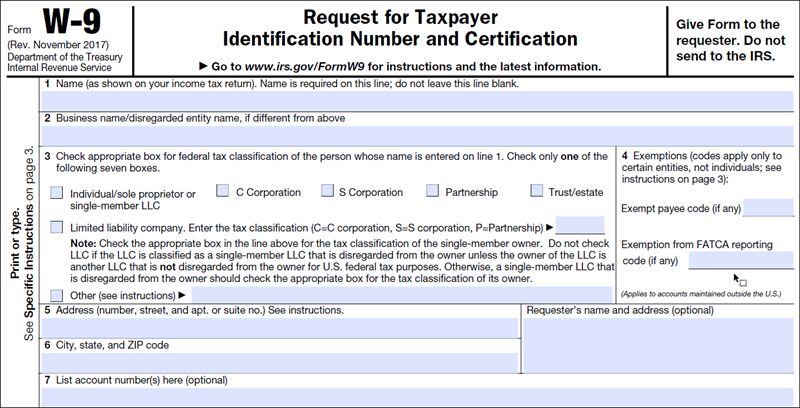

The IRS Form W-9 Request for Taxpayer Identification Number and Certification must have all applicable sections of the document completed by the potential State of Ohio supplier, including supplier name, taxpayer type, address, a valid tax identification number, and handwritten signatures. Supplier Operations forms are available through the State of Ohio Suppliers website.

Name or Business Name must be completed and match. If provided, will be entered or updated on the Identifying Information Tab.

Type of Entity (Check appropriate box for federal tax) must be marked. Will be entered or updated on the Identifying Information Tab. Business entity type must be provided unless it is an individual using their Social Security Number.

Address Information must be a complete address (building, street number, suite or apt. number, street, city, state, and zip). This may or may not match the Supplier Information Form. If a new supplier record is being created then we will enter this address on the Address Tab. If an address is on the W9 and/or W8 that is not already listed, add the address to the supplier record as an additional address.

A stamped address is acceptable.

Disregard any information in:

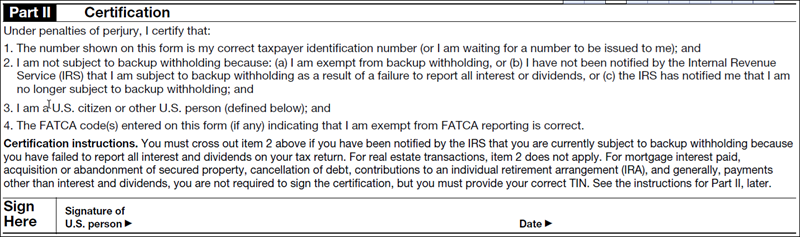

Part I Taxpayer Identification Number (TIN) must be completed. The TIN must be 9 digits for both a Social Security Number (SSN) and Employer Identification Number (EIN). Both numbers may be provided but one must match the information provided. This number will be entered on the Identifying Information tab.

A Social security number (SSN) may be provided for an individual, sole proprietor, or trustee.

To see a full page image of the W-9, click here.