Changing State Employee Classification

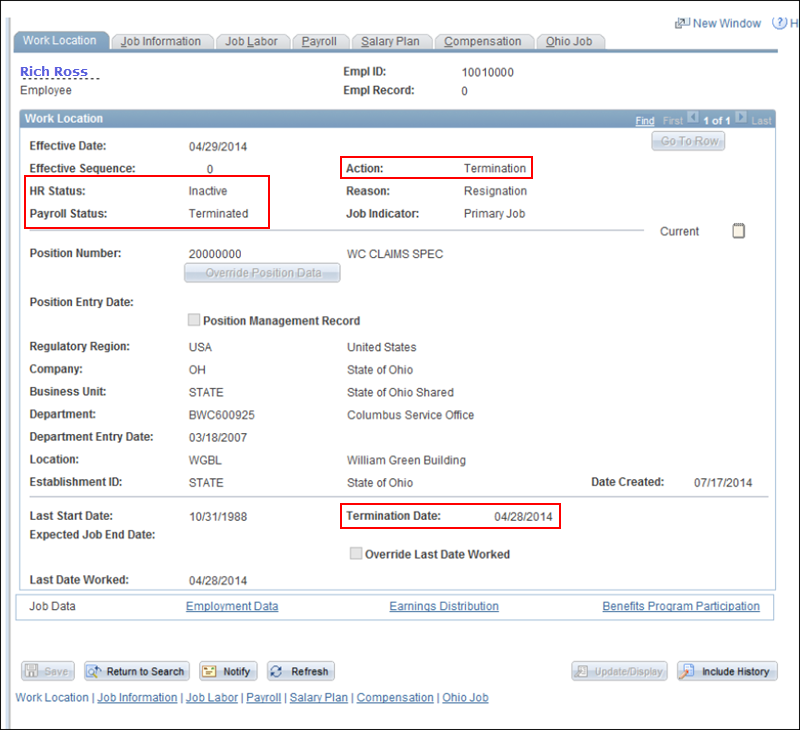

When an individual changes to a state employee or a state employee changes

to an individual and

the individual is using their social security number, a new Supplier ID

does not need to be created.

- If a state employee changes to an individual

with an Employer Identification Number (EIN) follow the "Adding a Regular Supplier" section.

Review Supplier Forms

Verify the following documents have been received and are complete.

- If an individual is changing to a state employee:

- If a state employee is changing to an individual:

Search for Supplier Record

Updating the Supplier Record

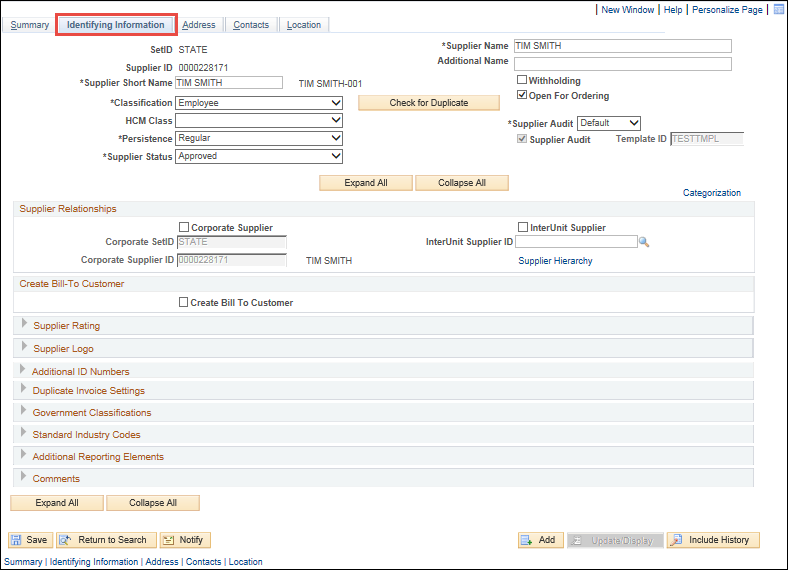

To begin, click on the

Identifying Information tab

Identifying Information tab.

Identifying Information tab

- Change the Classification

to:

- State Employee = "Employee" or

- Individual ="Supplier"

- Expand the Additional

ID Numbers section.

- Update the ID Number

field with:

- State Employee = "E" followed by the employee's

OAKS User ID (from the HCM paperwork) (e.g., "E10110001")

or

- Individual = Social Security Number

- If a state employee changes to an individual

with an Employer Identification Number (EIN) follow the "Adding a Regular Supplier"

section.

- Expand the Additional Reporting

Elements section.

- Select the applicable Type of

Contractor from the dropdown:

- State Employee = "State Employee" or

- Individual = "Social Security Number"

- All supporting documentation must be attached

to the supplier's record on the Identifying

Information tab.

- Acceptable form formats include JPEG,

PDF and TIF.

- Click herehere

for instructions on attaching supporting documentation to the

supplier record.

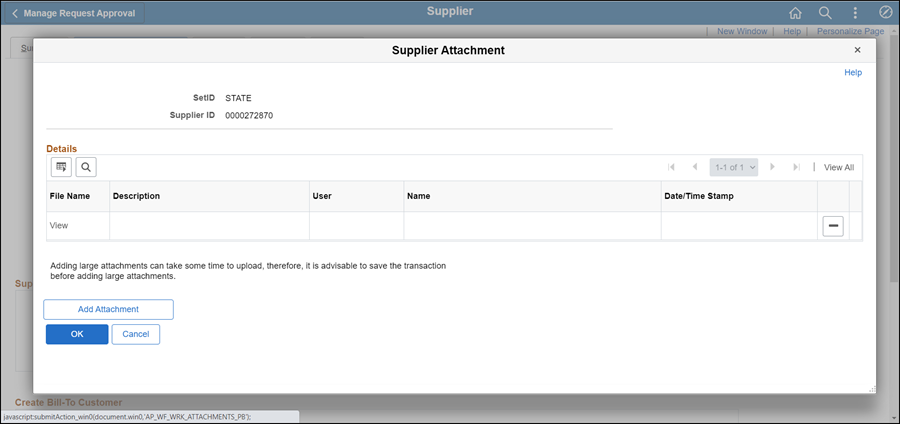

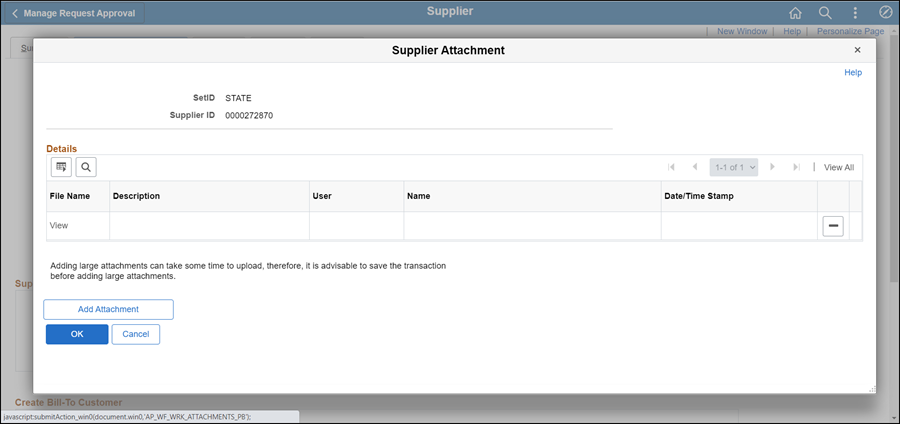

- Click the Attachments

link.

- The Supplier Attachment

page displays.

- Click Add Attachment.

- Copy the Document URL

from the Supplier Operations Tracker.

- Click Browse.

- Paste the Document

URL into the File

name.

- Click Open.

- Click Upload.

- The Supplier Attachment

page displays.

Update Description with <descriptive

name of the document> (e.g., "VIF W9 EFT").

Click OK.

- The Identifying

Information tab displays.

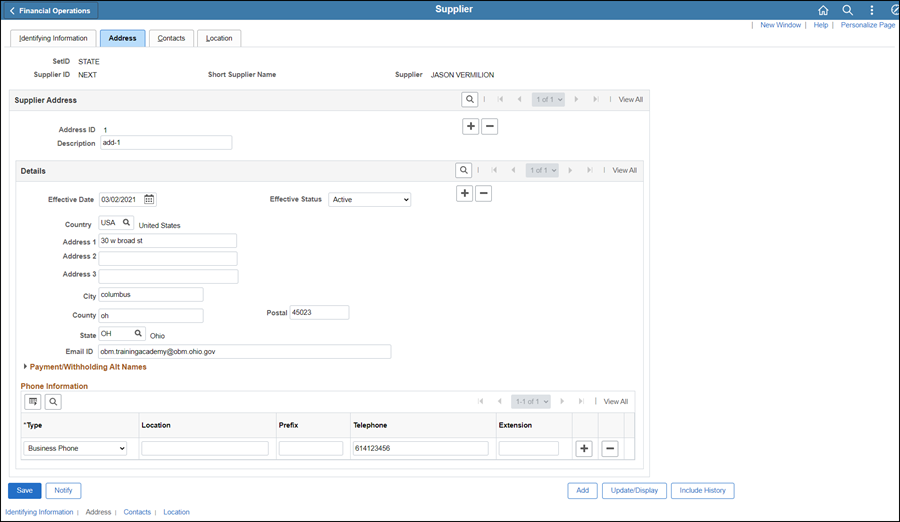

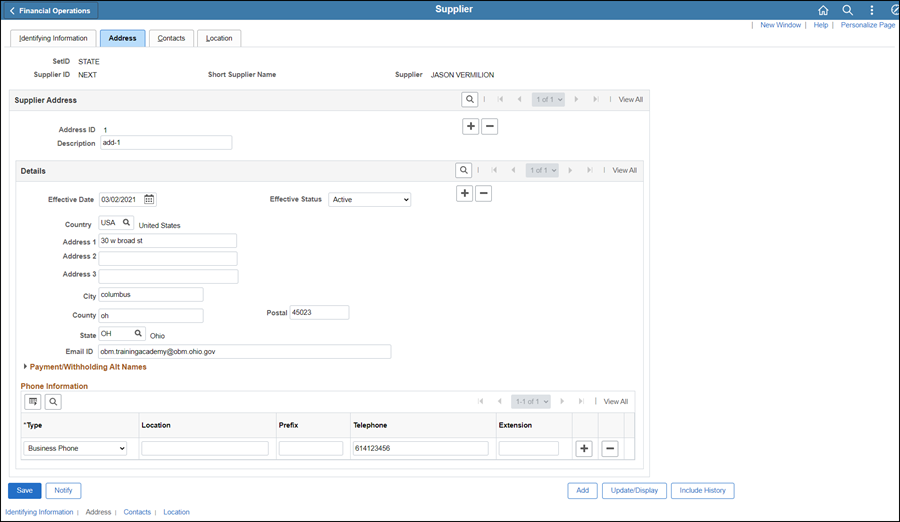

- Click the Address

tab.

Address tab

- Click the Add

a new row icon next to the Address

ID field.

- Update the Email

ID field with the work e-mail address, if provided.

- Do not enter a home e-mail address.

- Select Phone Information Type

dropdown and select the applicable option.

- The Prefix

field should remain blank.

- Update the Telephone

field with the phone number provided (format 6145555555).

- Click the Location

tab.

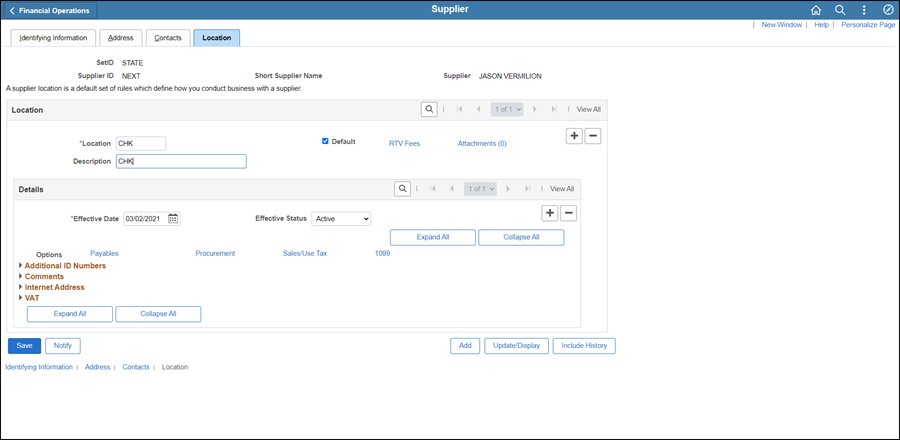

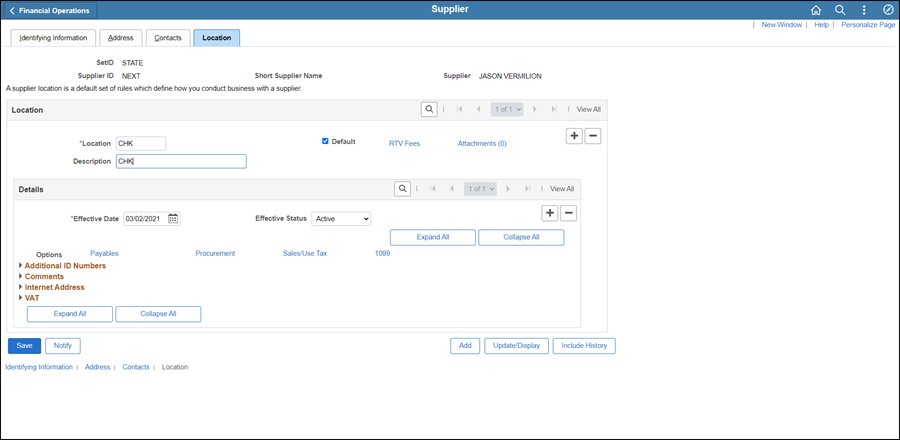

Location tab

- In the Details section, click the

Add a new row

icon next to the Effective

Status field.

- Click the Procurement link.

- Click Additional Procurement Options

to expand the section.

- If

updating a State Employee:

- Click the

Payment Terms Options

dropdown and select "Specify."

- Click the

Look Up Payment Term

ID icon and select "00 Due Now."

- If

updating an Individual:

- Click

the Payment

Terms Options dropdown

and select Default

from higher level.

- Click OK.

The

Location tab displays.

- If the supplier is being changed to a state employee, click

the 1099 link

on the CHK Location.

- Enter "IRS" (Internal Revenue Service)

in the Entity field.

- Enter "1" in the Address

field.

- Enter "S" (Social Security Number) in the TIN

Type field.

- Enter the employee's social security number in

the Taxpayer Identification Number

field.

- Click OK.

- The Location tab

displays.

- Click the Comments collapsible region.

- Enter Comment,

"<Date> <Description of changes> <associate's

initials>" at the top of the field (above any previous comments).

- Do not delete previous comments.

- Click Save.

- The Preview Supplier

Audit page displays an audit of the changes made

to the suppliers account.

- Click OK.

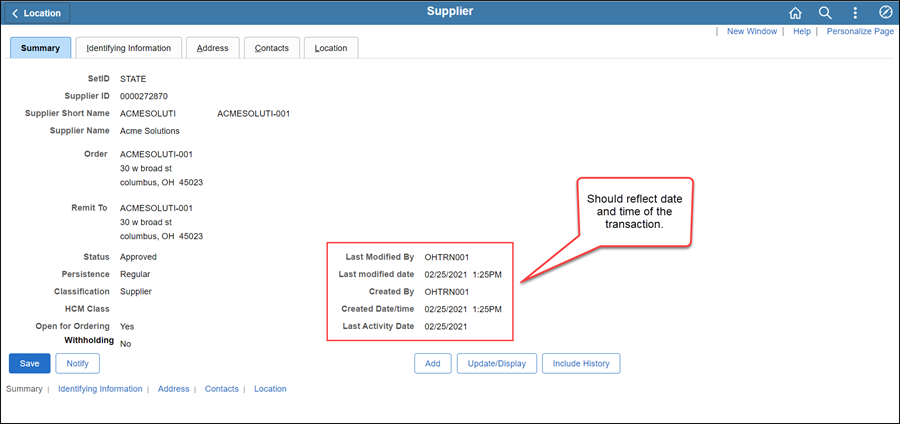

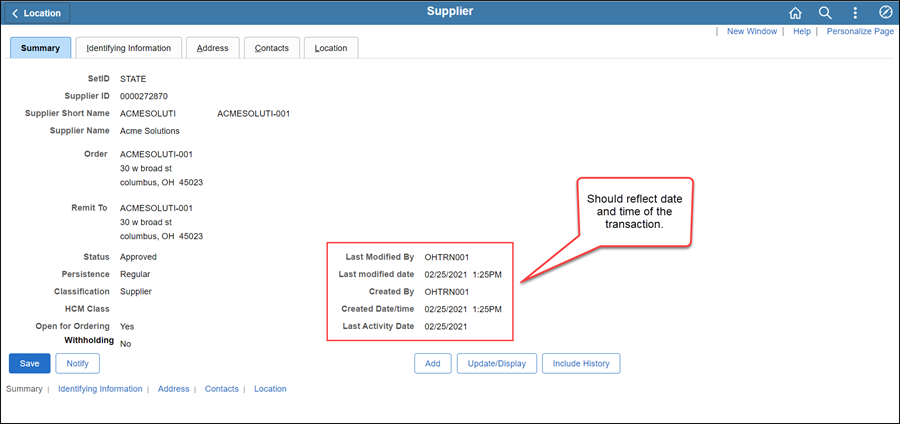

- Click the Summary tab.

Summary tab

The supplier file Summary tab

provides an overview of the supplier record.

Once all updates have been made to the supplier record, review

the Summary tab to

verify that the record was modified.

Next steps - Updating the Supplier

Operations Tracker

Next steps - Updating the Supplier

Operations Tracker