Effective: 10/04/2018

The Form W-8BEN series is used by foreign persons to certify they are the beneficial owner of the U.S. payment. A Form W-8BEN is used by persons claiming income received is effectively connected with a U.S. trade or business and is provided to a withholding agent by a foreign recipient who is the beneficial owner of a reportable amount. Supplier Operations forms are available through the OBM Shared Services website. For more information on OBM Shared Services supplier forms, customers may inquire via our contact us page or call 614-338-4781 or 1.877.OHIOSS1 (1.877.644.6771).

We will accept any W-8, as there are several different versions.

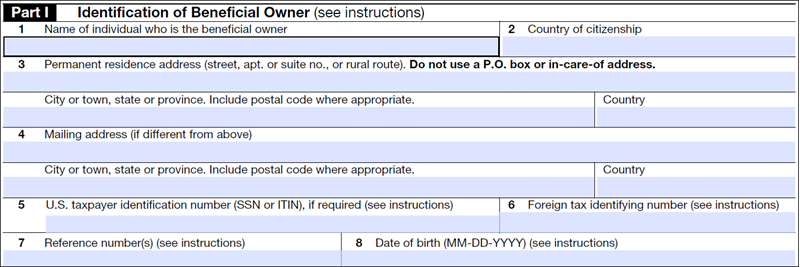

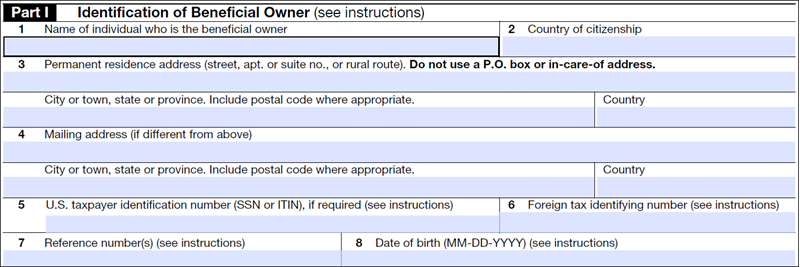

Box 1: Name of individual or organization - must be listed. Must match name(s) listed on the Supplier Information Form. Will be entered or updated (if applicable) on the Identifying Information Tab in the Supplier Module.

Box 2: Country of citizenship. Not required.

Box 3: Permanent residence address, City or town, state or province. A complete address must be listed in Box 4. This may or may not match Supplier Information Form completely. If a new supplier record is being created we enter this address on the Address Tab in the Supplier module in addition to the address from the Supplier Information Form Section 3 or 4. If an address is on the W9 and/or W8 that is not on the Supplier Information Form, add the address to the supplier record as an additional address.

Box 4: Mailing address. A complete address must be listed in Box 3. This may or may not match the Supplier Information Form. If a new supplier record is being created then we will enter this address on the Address Tab in the Supplier module in addition to the address from the Supplier Information Form in Section 3 or 4. For an update the address to be replaced must be listed in Section 1 of the Supplier Information Form (SIF).

Box 5: U.S. taxpayer identification number The TIN must be 9 digits for both a Social Security Number (SSN) and Employer Identification Number (EIN). Both numbers may be provided but one must match the information provided on the Supplier Information Form and match the supplier record (if applicable). This number will be entered on the Identifying Information Tab in the Supplier module. If they do not list a number then a “dummy number” is requested. We do not reject the form.

Box 6: Foreign tax identifying number (DO NOT ENTER THIS AS TIN IN OAKS). If they do not list a number in Box 7 then a “dummy TIN number” is requested. We do not reject the form. Should be ignored if listed on the Supplier Information Form.

Box 7 – Box 8 Not required.

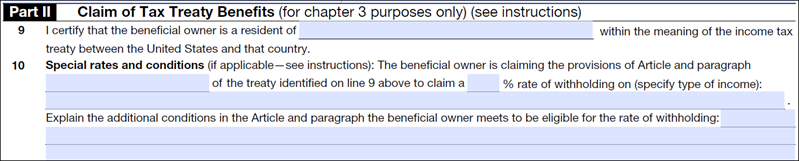

Box 9: Resident

Box 10: Special rates and conditions

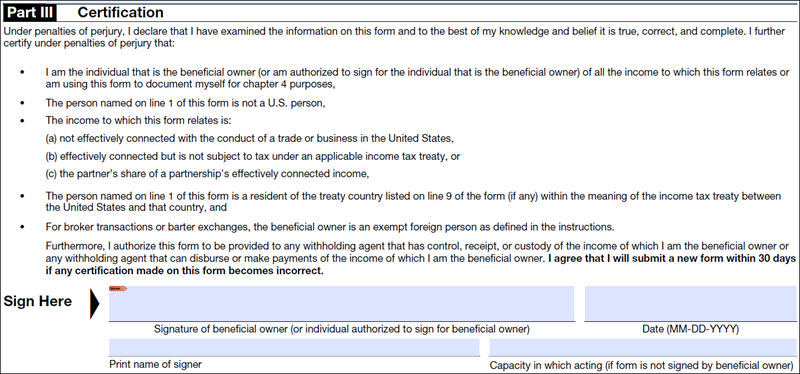

The name must be handwritten.

Electronic & stamped signatures are not accepted at this time.

May or may not match the signature section on the Supplier Information Form.

Printed Name and/or Date are not required.

"I certify" box is not required.

To see a full page image of the W-8, click here.