Previous steps - Adding a Regular Supplier

Previous steps - Adding a Regular SupplierEffective: 04/07/2022

Previous steps - Adding a Regular Supplier

Previous steps - Adding a Regular Supplier

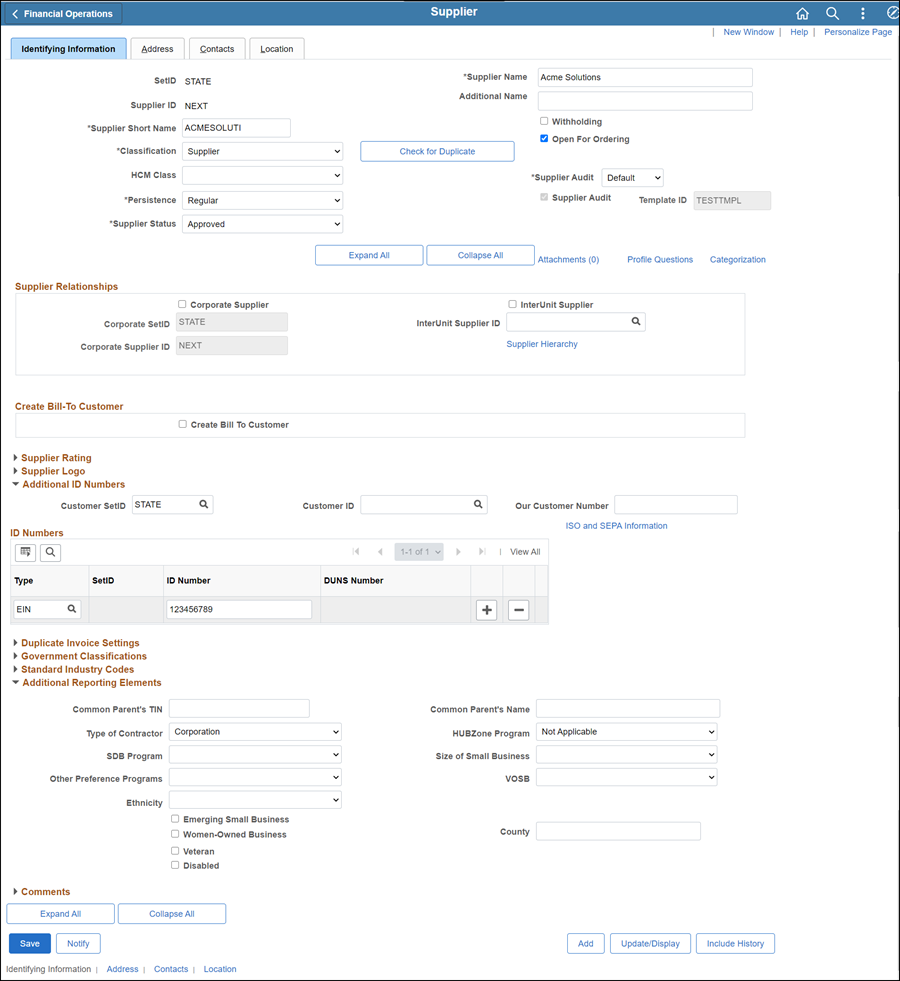

Enter Supplier Short Name with the first 10 characters of the supplier name as listed on the "IRS Form W-9."

If supplier forms list an acronym after the business name, add the acronym after the business name (do not add as a DBA).

Enter the supplier's name in the Supplier Name field as listed on the "IRS Form W-9" or "IRS Form W-8" (40 character limit).

For sole proprietor businesses enter the name in the Supplier Name field and enter the Individual’s name in the Additional Name field.

If the user does not have proper security, the Status will be "Unapproved" and another member of the Supplier Operations team (with proper access) should be notified.

Confirm that Classification is "Supplier."

If the supplier is a Government Entity, select "Permanent."

If SSN is provided on the W-9, the individual name must be provided in addition to the business name.

Click herehere for guidelines.

|

Federal Tax Classification (W-9) |

Type (OAKS) |

ID Number (OAKS) |

Type of Contractor (OAKS) |

| Individual | TIN | Social Security or Employer Identification | Social Security or Tax Identification |

| Sole Proprietor/ Single Member LLC | SP & TIN | Social SecuritySocial Security

or Employer Identification

If Social security number is provided, the individual name and company name must be provided on the W-9. |

Social Security or Tax Identification |

| C CORP / S CORP | TIN | Employer Identification | Corporation |

| Partnership | TIN | Employer Identification | Tax Identification |

| Trustee / Estate | TIN | Employer IdentificationEmployer Identification

An estate should have an EIN if the payments are related to income earned by the deceased's possessions (e.g., rental income). An estate can use a SSN if it is for money owed directly to the deceased for wages or services they provided while alive. |

Social Security or Tax Identification |

| Limited

Liability (LLC)Limited

Liability (LLC)

*C CORP = Corporation *S CORP = Corporation *Partnership = Tax Identification *If not specified = Tax Identification |

TIN | Employer Identification | Tax Identification or Corporation |

| Other

- NonprofitNonprofit

May be listed as "Public Charity," "501(3)(c)," etc. |

TIN | Employer Identification | Corporation |

| Other - Association | TIN | Employer Identification | Tax Identification |

| Other

- Government

EntityGovernment

Entity

May indicate "Municipal Corporation." |

TIN | Employer Identification | Government Entity |

|

Other - State Business Unit/Agency - No W-9 Required |

TIN | 00<Agency Acronym>0000 (If provided) | State Agency |

| HCM screen shots

- No W-9 RequiredHCM screen shots

- No W-9 Required

See employee set-up. |

TIN | State Employee Identification |

State Employee |

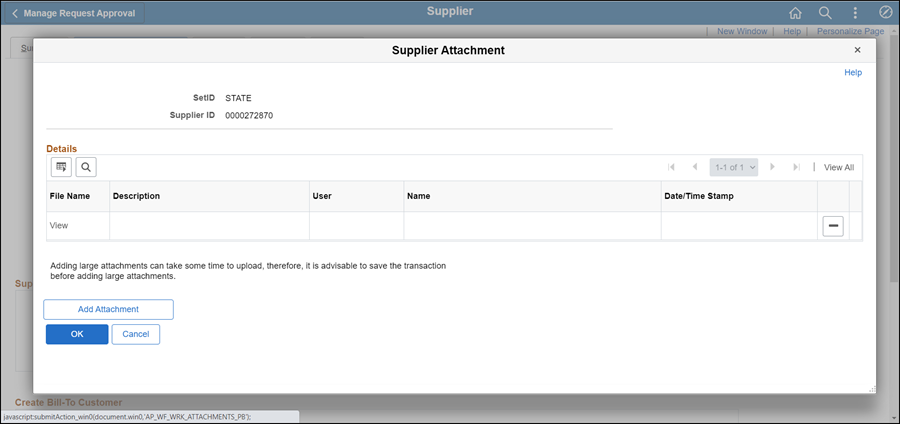

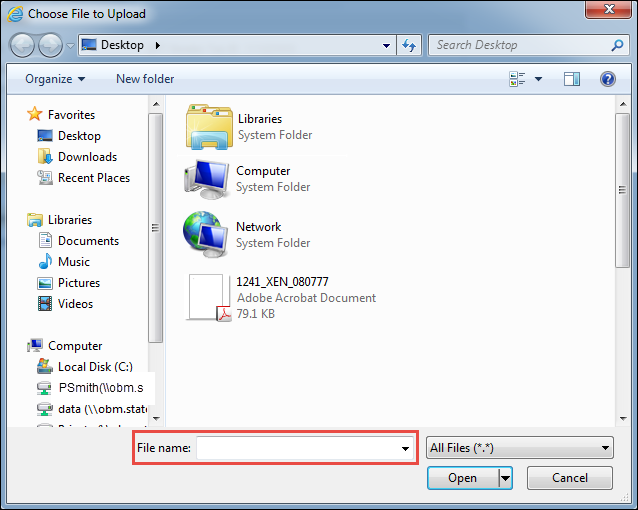

Update Description with <descriptive name of the document> (e.g., "VIF W9 EFT").

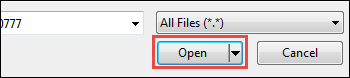

Repeat steps 2-8 for each document to be uploaded.

Click OK.

Next steps - Creating a Supplier Record - Address tab

Next steps - Creating a Supplier Record - Address tab