Adding a "Doing Business As" (DBA) Supplier

A "Doing Business As" (DBA) supplier is a corporation or LLC that uses a registered trade name other than its primary business name. This procedure is used for those suppliers using a Tax ID Number (TIN) registered to another business name (i.e., parent company). DBA suppliers are set up in OAKS FIN differently from regular suppliers because they are tied back to the owner of the TIN for IRS reporting purposes.

DBA suppliers are not setup for Department of Health (DOH) WIC suppliers.

When updating a Sole Proprietor supplier record with DBAs, the order of the company names does not matter.

When a Supplier Information Form (OBM-5657) and IRS Form W-9 are received with a DBA name listed, two supplier records are created: (one with the parent company and one with the DBA).

- The supplier record for the parent company is created first using the standard supplier creation process.

- The procedure to add the DBA supplier, Trade Name supplier, or division supplier is the same as the standard supplier creation process, but with the following exceptions:

"Doing Business As" Exceptions

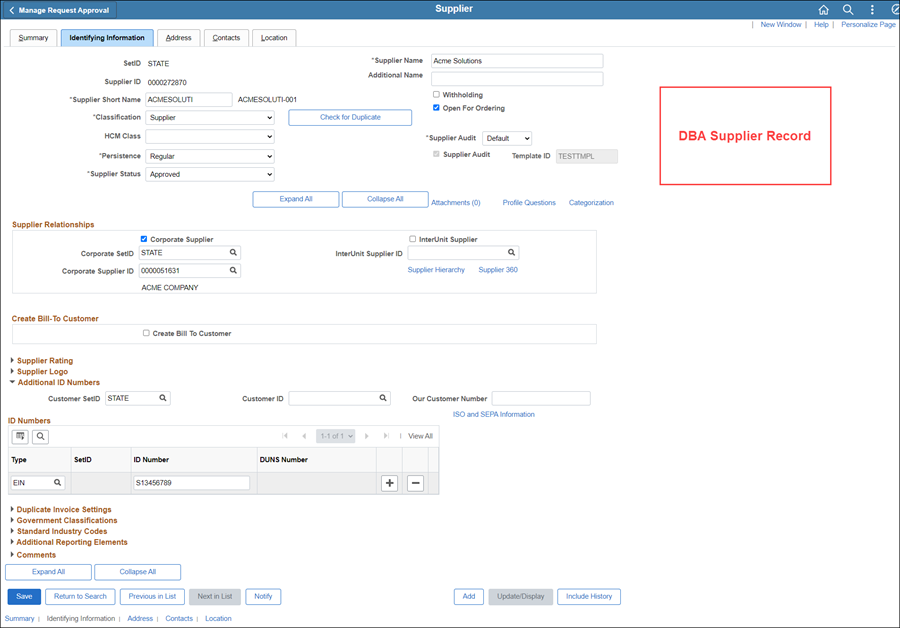

On the Identifying Information tab:

- If the supplier is a "DBA" supplier, a division of the owner's company, or a supplier using a Trade Name or nickname:

- Select the Corporate Supplier checkbox.

- The Corporate Supplier ID field will automatically populate with the DBA Supplier's ID.

- Update the Corporate

Supplier ID field with the parent company's Supplier ID.

- This can only be done once the parent is in Approved status.

- Under the Additional

ID Numbers section, enter "TIN" under

Type and replace the first

2 numbers of the TIN/SS# with "S1"

and then enter the last 7

of the TIN/SS# (e.g., S12831259).

- If more than one DBA name exists, enter others as "S2," "S3," etc.