Supplier Tax ID Number Change

Suppliers often obtain a new Tax ID Number when the type of business

entity changes, a business is merged, etc. When this occurs, the supplier

will submit a request to OSS to update their supplier record in OAKS FIN.

Review Supplier Forms

Ensure

that the proper and complete documentation for the requested change has

been received:

Search for Existing Supplier Record

Obsolete Existing Supplier Record

- If there are open invoices for the supplier:

- Proceed to create a new supplier record.

- Do not obsolete

the current supplier record.

- Continue

to run unpaid voucher report daily. Once there are no open

transactions, obsolete the current supplier record.

- If there are no

open invoice(s) for the supplier, proceed to the next step

for creating a new supplier record and obsoleting the current

supplier record.

Create New Supplier Record

A new supplier record will be created in OAKS FIN with the new tax ID

number to replace the existing supplier record with the old tax ID number.

- Click New

WindowNew

Window link to open a separate instance

of OAKS FIN.

- Refer to the "Adding

a New Supplier" section to create a new supplier with the

new Tax ID number on the updated W-9.

- Click the Identifying Information

tab.

- All supporting documentation must be attached

to the supplier's record on the Identifying

Information tab.

- Acceptable form formats include JPEG,

PDF and TIF.

- Click herehere

for instructions on attaching supporting documentation to the

supplier record.

- Click the Attachments

link.

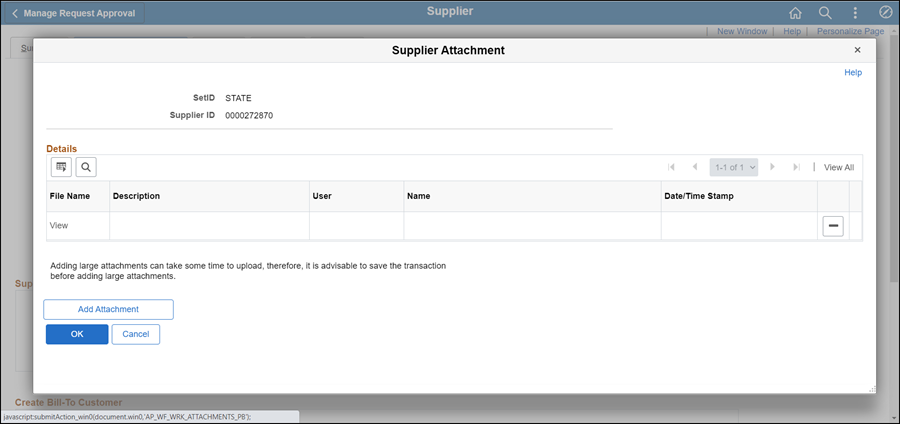

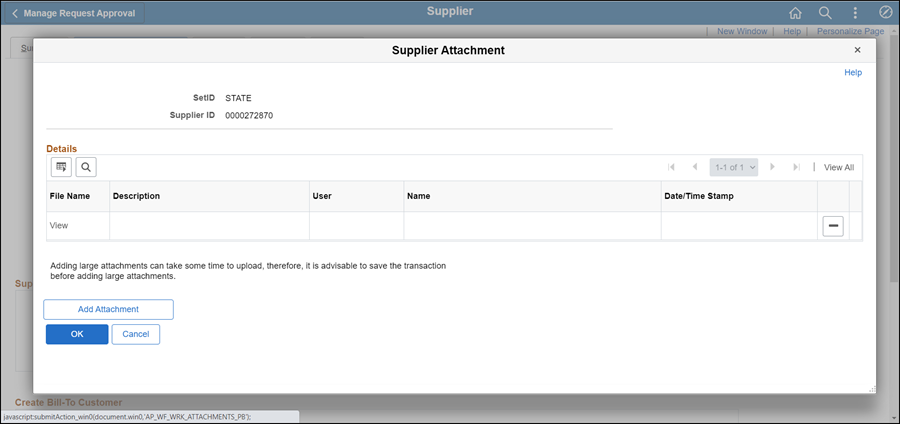

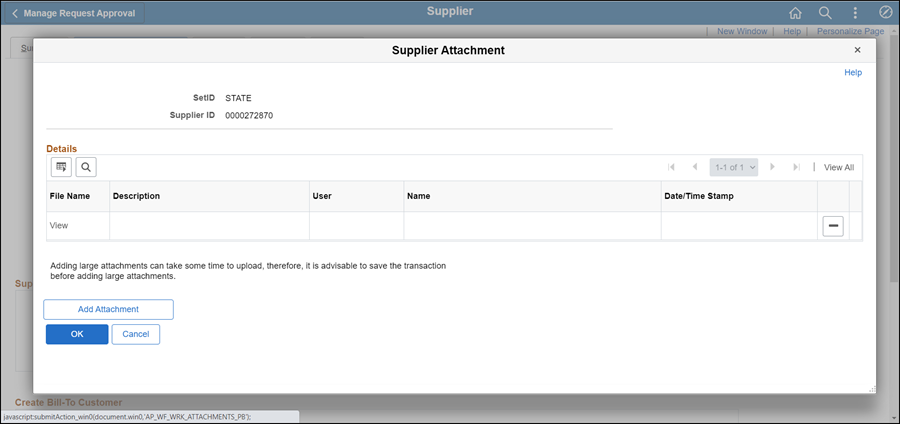

- The Supplier Attachment

page displays.

- Click Add Attachment.

- Copy the Document URL

from the Supplier Operations Tracker.

- Click Browse.

- Paste the Document

URL into the File

name.

- Click Open.

- Click Upload.

- The Supplier Attachment

page displays.

Update Description with <descriptive

name of the document> (e.g., "VIF W9 EFT").

Click OK.

- The Identifying

Information tab displays.

- Click the Location tab.

- Click the Comments

collapsible region.

- Enter Comment,

"<Date> "replaces <supplier ID number> due

to change of TIN" <associate's initials>"

at the top of the field (above any previous comments).

- Do not delete previous comments.

- Return to the supplier record becoming obsolete (with the old tax

ID number) opened in a separate window.

- If the forms received indicates that the supplier

would like the old Tax ID obsoleted, then proceed to step 1 of "Obsolete

Supplier Record" below. If the old Tax ID is to remain active,

click the Summary

tab and proceed to the Summary

tab instructions below.

Obsolete Supplier Record

The supplier record containing the old tax ID number must be marked

supplier obsolete.

- Click the Identifying Information

tab of the old Supplier ID.

- Uncheck Open For Ordering

checkbox.

- All supporting documentation must be attached

to the supplier's record on the Identifying

Information tab.

- Acceptable form formats include JPEG,

PDF and TIF.

- Click herehere

for instructions on attaching supporting documentation to

the supplier record.

- Click the Attachments

link.

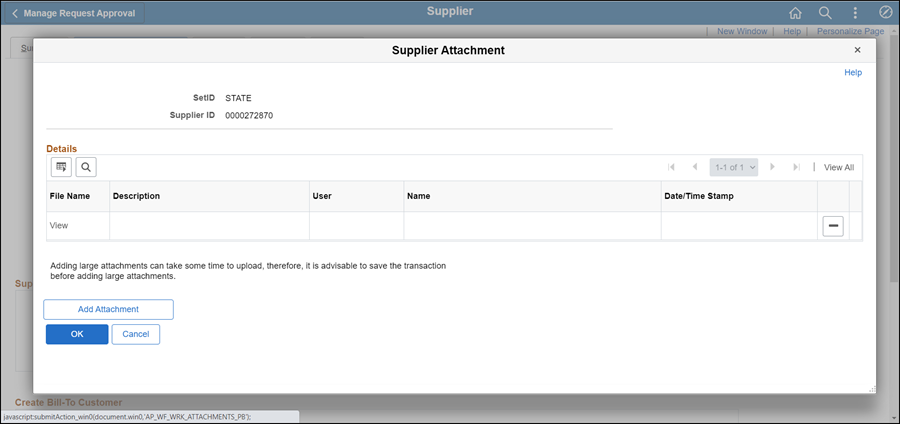

- The Supplier Attachment

page displays.

- Click Add Attachment.

- Copy the Document

URL from the Supplier Operations Tracker.

- Click Browse.

- Paste the Document

URL into the File

name.

- Click Open.

- Click Upload.

- The Supplier Attachment

page displays.

Update Description with <descriptive

name of the document> (e.g., "VIF W9 EFT").

Click OK.

- The Identifying

Information tab displays.

- Click the Address

tab.

- On all

of the Address pages:

- Click the Add

a new row icon in the Details

Section.

- Confirm the Effective

Date displays today's date.

- In the Address 1 field, enter "SUPPLIER OBSOLETE USE

<Supplier ID #>."

- In the City field,

enter "OBSOLETE."

- Clear the County

field.

- Enter State, "OH."

- Replace the Postal

fields with "99999".

- Clear the

Email,

Telephone, and

Fax fields.

- Click the Contacts

tab.

- Click the Add a new row

icon in the details section to add a

row.

- Confirm the Effective

Date displays today's date.

- Select Inactive from

the Status dropdown.

- Click the Location

tab.

Click the Add a new row

in the details section to add a row to the CHK location.

Confirm the Effective Date

displays today's date

Click the Payables

link.

Select the Additional Payables

Options section.

Check Hold Payment

checkbox in the payment control section.

Repeat this process for each payment method.

- If PO Dispatch Locations exist:

Click the Add a new row

in the details section to add a row to the Email and Fax locations.

Confirm the Effective Date

displays today's date

Change Status to

Inactive.

- Click Save.

- The Preview

Supplier Audit page displays an audit of the changes

made to the suppliers account.

- Click OK.

- Click the Summary tab.

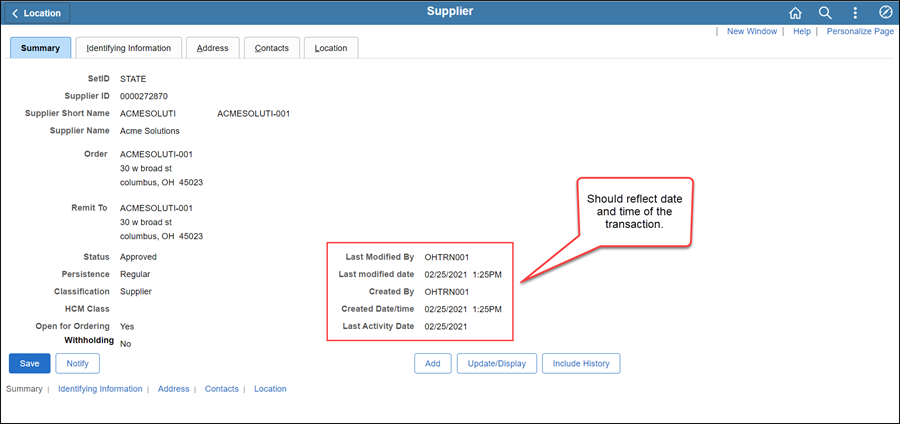

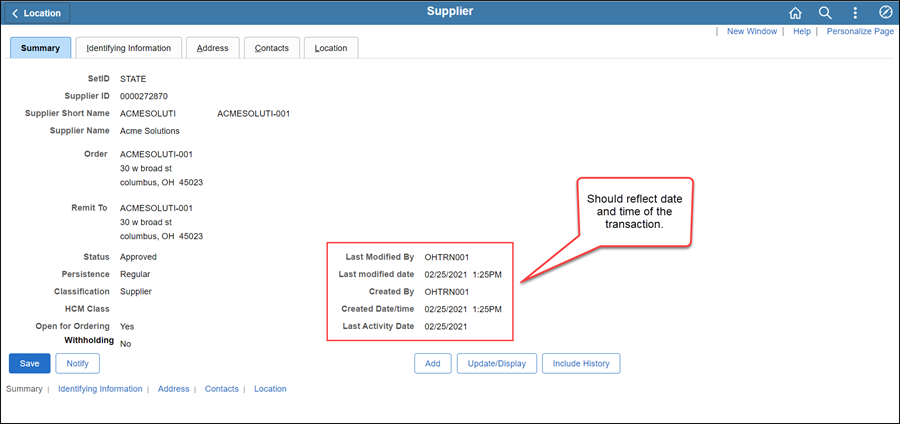

Summary tab

The supplier file Summary tab

provides an overview of the supplier record.

Once all updates have been made to the supplier record, review

the Summary tab to

verify that the record was modified.

Next steps - Updating the Supplier Operations

Tracker

Next steps - Updating the Supplier Operations

Tracker

Next steps - Updating the Supplier Operations

Tracker

Next steps - Updating the Supplier Operations

Tracker